- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 1 Aug 2025

Weekly Metals Mining Rundown for Week Ending 1 Aug 2025

Most metal prices and mining stocks fell this past week; Copper took the biggest hit of nearly 24% on Trump tariff news, with larger-cap lithium stocks bearing the brunt among miners with losses extending into double digits as the Li price dipped back below US$10,000/t Li carbonate; Gold price bounced back Friday for a slight weekly gain, and rhodium gained 12%, after losing 6% Friday

This past week’s top & bottom metal price and mining company peer group movers include:

1 Aug 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 489) include (share price rounding errors apply, as sourced from Google Finance):

Covered metals mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

28 July 2025 - Intermediate gold producer Torex Gold Resources Inc (TSX:TXG) announced the acquisition of gold explorer Prime Mining (TSX:PRYM) along with its multi-million ounce Los Reyes gold-silver project in Mexico in an all-stock deal, which adds a quality near-development/advanced-exploration stage asset to TXG’s diverse Mexican portfolio that already includes production of gold, silver, and copper. PRYM shareholders are to receive a 32.4% premium to 30-day VWAP and TXG will issue roughly 10.5m shares to proforma shares of 96.71m (dilution of ~12%) to add PRYM’s 2.8 Moz AuEq (77% Au, 23% Ag) at our estimated 3-month trailing average metal prices, which grows TXG’s resources by a substantial 32% to 11.6 Moz AuEq (74% from Au, 13% Cu, 13% Ag), which closed the week ending 1 Aug at a pro-forma market cap/oz AuEq resource of US$236/oz, which has been reduced by this deal to just below our 55-company intermediate gold producer mean market cap/oz of $242/oz AuEq.

27 Jul 2025 - Intermediate gold producer and copper developer McEwen Inc. (NYSE:MUX) announced the acquisition of gold explorer Canadian Gold Corp (TSXV: CGC) in all-stock deal, along with its past-producing Tartan Lake gold mine project, for which MUX has better funding capacity to advance through development. MUX gets Tartan’s starter resources of ~0.3 Moz including a high-grade 0.24 Moz @ 6.3g/t in the indicated category. CGC shareholders get a 26% premium to VWAP and are set to receive 0.0225 MUX shares for each CGC share, and are set to own 8.2% of combined company. MUX’s basic shares outstanding to increase from Google Finance’s 54m, to 58.7m proforma. MUX shares are down -12% over past week (ending 1 Aug) vs. intermediate gold producer median down -8% to MUX share price US$10.03, pro-forma market cap $589m or (proforma) market cap/oz resource of $18/oz AuEq for its ~33Moz AuEq resources - for a 89% discount to our 55-company intermediate gold producer median $167/oz (MUX market cap/oz for its 6Moz gold only excluding copper is $98/oz - still a 41% discount to int gold producer median $167/oz). Against copper developer peers (MUX is a producer), MUX trades at US$0.026/lb CuEq ($18/oz AuEq) - just above our 34-company copper developer group median US0$0.20/lb CuEq ($14/oz AuEq) and well below mean $0.051/lb CuEq ($35oz AuEq). CGC stock traded down -3% over past week (ending today 1 Aug) to C$0.30/sh - vs 92-company gold explorer group mean loss -1%.

29 July 2025 - Former lithium hard rock explorer - now lithium hard rock developer - Wildcat Resources (ASX:WC8) announced results of a PFS for its 100%-owned Tabba Tabba project in Western Australia, confirming potential for a long-life mine with a post-tax NPV8 of A$1.2b at broker consensus spodumene (6%) price of US$1,384/t spodumene from pre-production capital of A$687m. While we only NAVs for Li hard rock developers with commodities lithium carbonate or hydroxide as a product, WC8’s resources of ~1.8 Mt LCE (~5.1 Moz AuEq) trade at a 1 Aug WC8 market cap/t of US$71/t LCE ($25.5/oz AuEq) - a 20% discount to our 17-company lithium hard rock developer peer group median $89/t LCE (US$32/oz AuEq).

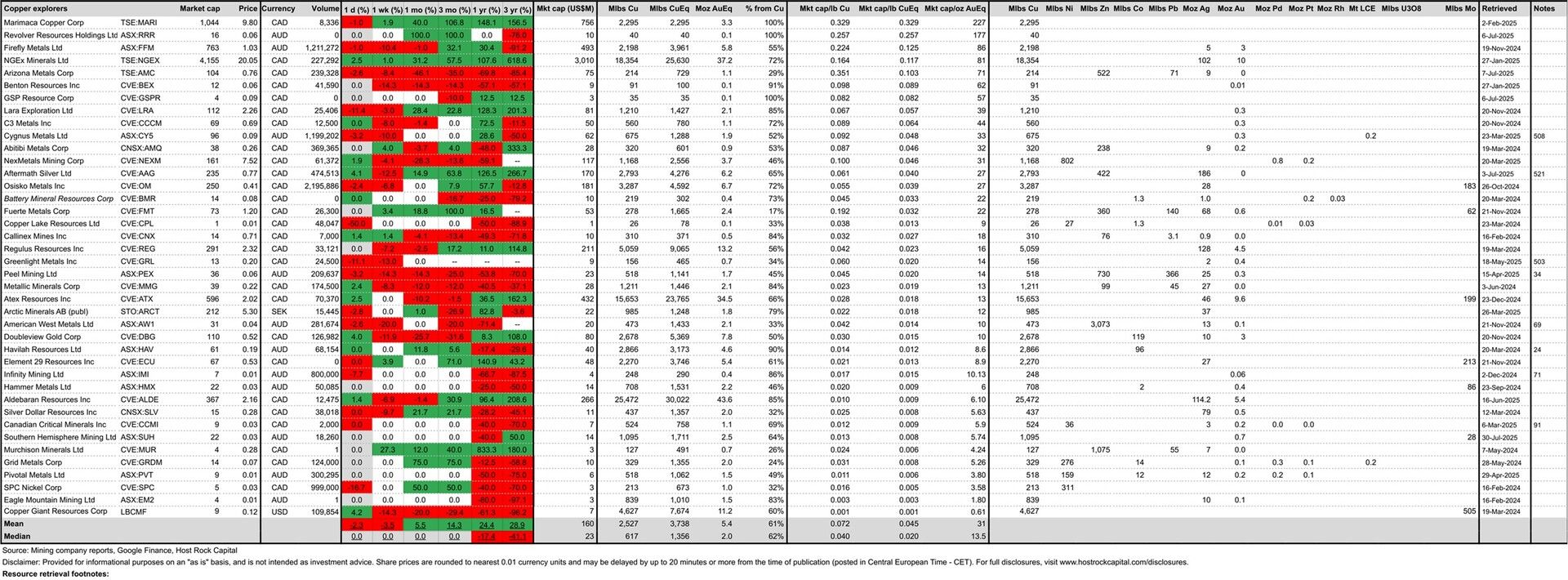

30 July 2025 - Copper explorer Southern Hemisphere Mining Limited (ASX:SUH) announced an updated JORC resource estimate of 218 Mt grading 0.38% CuEq for 496,600 t Cu (1.1 Bt Cu), which included significant conversion to measured and indicated category now amounting to 174Mt grading 0.24% Cu and 0.10% Au. SUH stock traded up +3.5% on 30 July following this news to ~A$0.03/sh (vs. 40-company copper explorer mean daily performance of +1.4%), before closing the week (ending 1 Aug) flat +0% (vs. peer group mean loss -3.5%) at a market cap A$22m, and market cap/lb resource of US$0.008/lb CuEq ($5.3/oz AuEq) - a 60% discount to copper explorer median $0.020/lb CuEq ($13.5/oz AuEq).

Disclaimer: Provided for informational and educational purposes on an “as-is- basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.