- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 11 April 2025 - Precious Metals Prices and Mining Equities Rise Sharply

Weekly Metals Mining Rundown for Week Ending 11 April 2025 - Precious Metals Prices and Mining Equities Rise Sharply

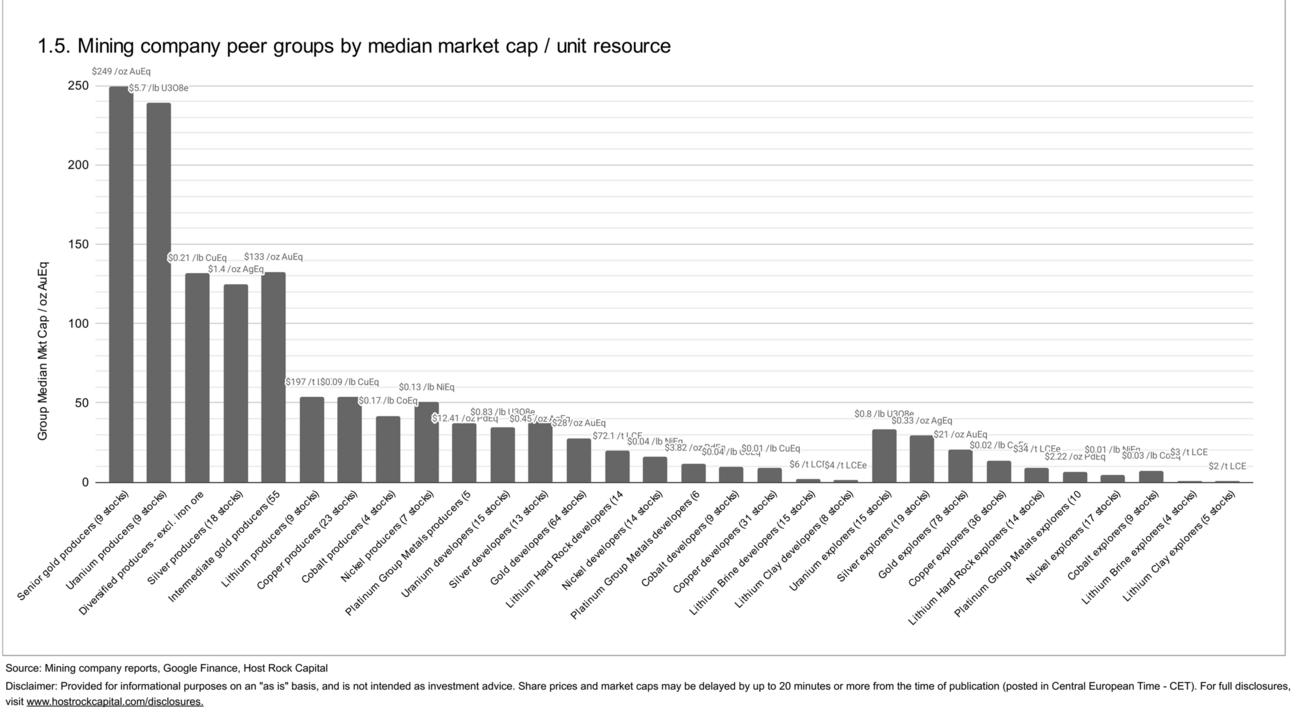

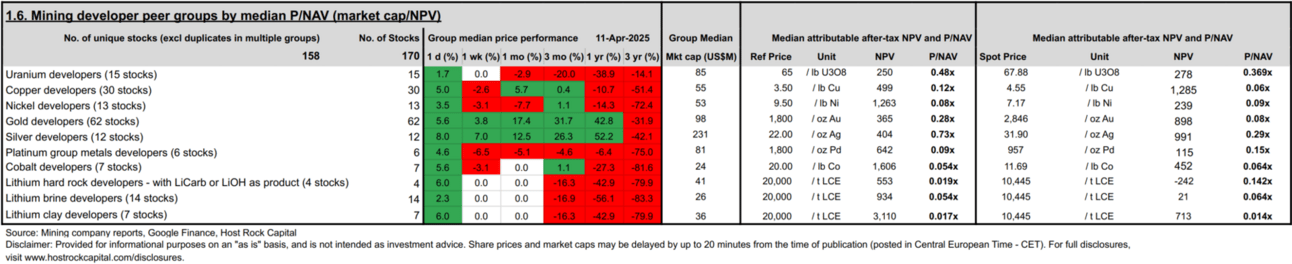

Rundown of company announcements, valuations, and underlying metal prices, according to our compilation of publicly available information covering 9 important metals and more than 450 mining stocks, including mineral resource inventories, and including project NPV information for some 150+ developers.

This past week’s top & bottom metal price and mining company peer group movers include:

11 Apr 2025

11 Apr 2025

11 Apr 2025

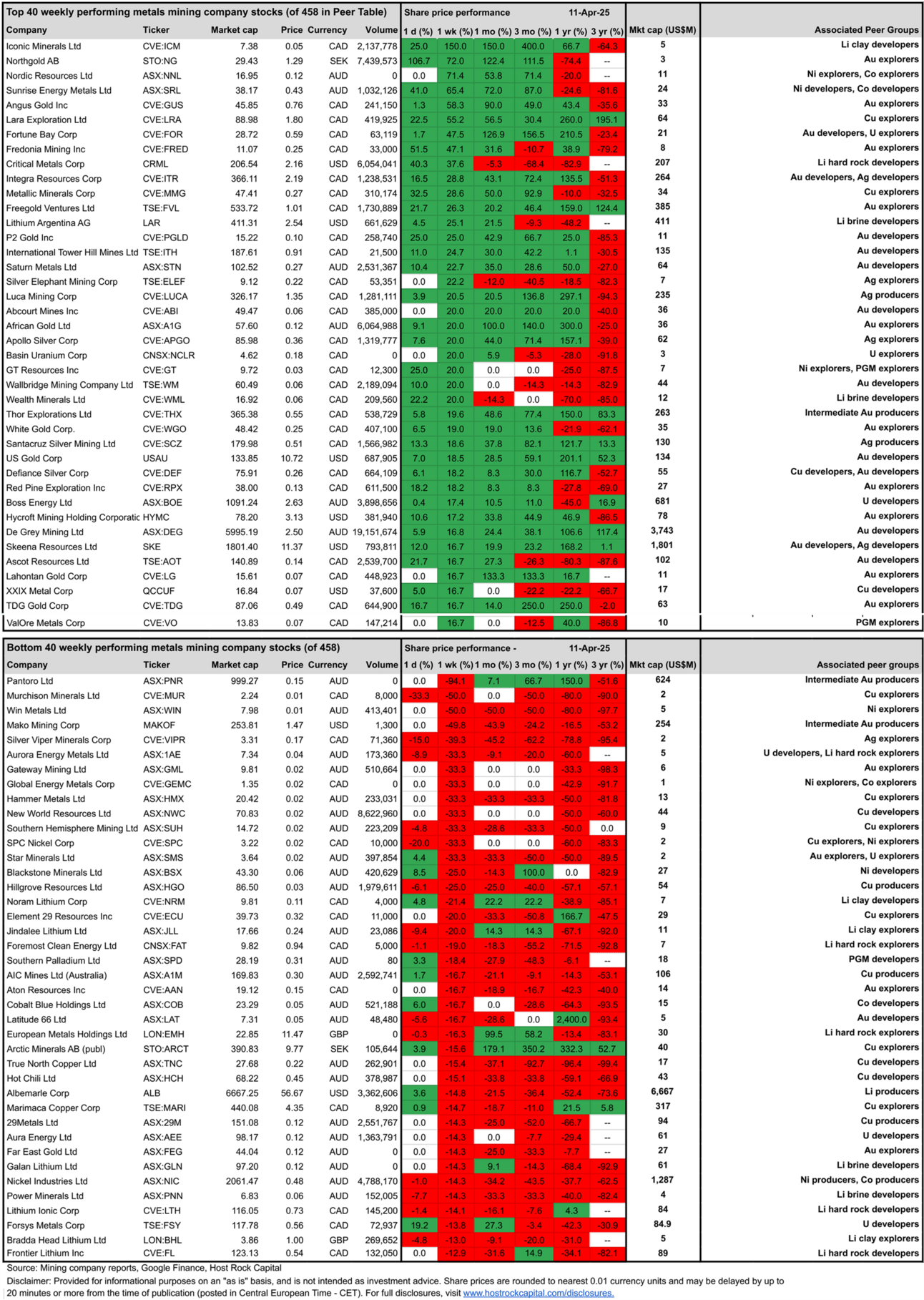

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 457) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in attributable project ownership) includes:

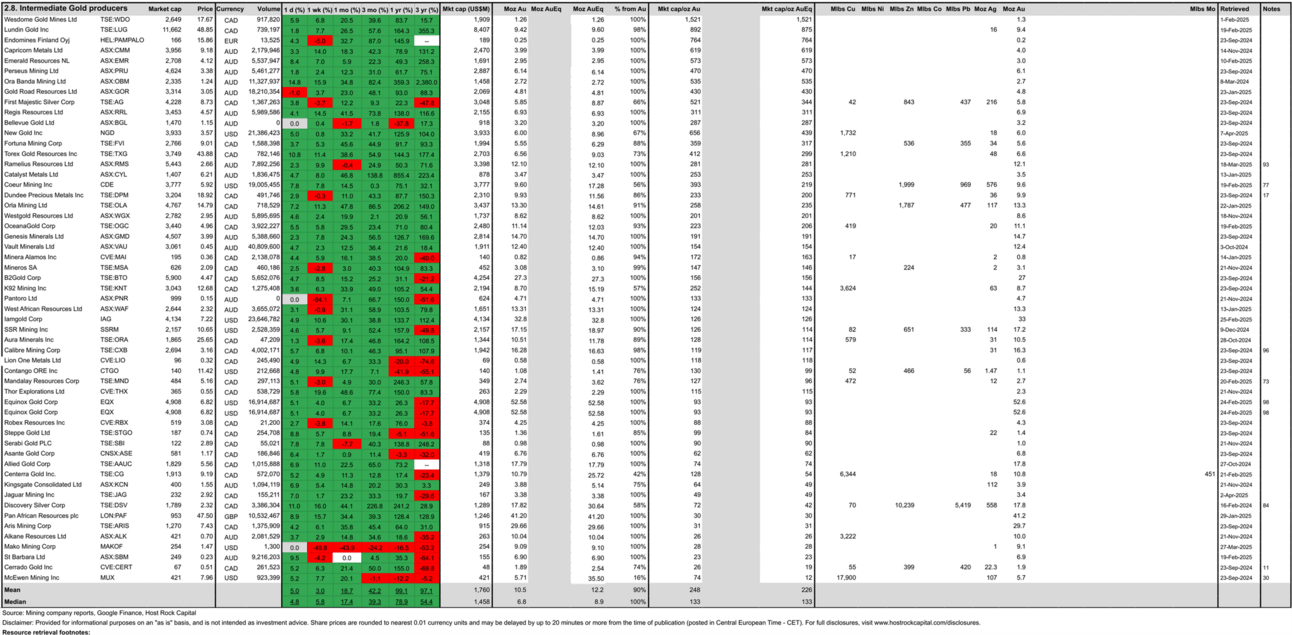

8 April 2025 - Intermediate gold producer Genesis Minerals (ASX:GMD) announced its annual reserves and resources update. Reserves were more than replaced and grew by 12% after depletion of 170 koz Au, to 54Mt @ 2.1 g/t Au for 3.7 Moz. Growth included a maiden reserve for Westralia open pit of 370 koz, which is 15 km from the company’s Laverton mill and was acquired by the company in a takeover in 2022. Mineral resources remained largely unchanged (down slightly on optimized/tighter pit shell and slopes) at 210 Mt @2.2g/t for 14.7Moz. GMD stock closed the week (ending 11 Apr) up 8% (vs. peer group median up +6.5%) following this news earlier in week to a week ending (11 Apr) market cap / oz resource of US$191/oz Au, which is well below our below Peer Table’s 55-company intermediate gold producer peer group mean market cap/oz of $226/oz, and above median $133/oz.

11 Apr 2025

7 April 2025 - Gold explorer Renforth Resources (CSE:RFR) announced an updated resource estimate for its flagship Parbec project in Quebec next door to Agnico Eagle’s (NYSE:AEM) producing Malarctic Mine (and other nearby satellite development project Marban that AEM picked up in O3 Mining acquisition). RFR grew its resources by 29% in this update to 0.36 Moz @ 0.93 g/t Au (M&I&I, mostly open pit with some underground) - with 12% of the new resource ounces in the Measured category within the resource pit shell, helping to define higher-confidence, slightly higher-grade starter-pit material to help bolster economics in future possible economic studies, possibly in conjunction with Malarctic and/or Marban (after more resource growth, as RFR states in the release that this resource update and associated drilling also presented them with new drill targets within deposit to target gaps in drill spacing and to upgrade remaining inferred ounces). RFR traded flat today intraday TSX (April 7) following this news on strong volume (already ~6x average) before also closing the week (ending 11 Apr) flat +0% (in line with peer group median +0%) to a (11 Apr) market cap/oz resource of US$6.8/oz Au - a wide 67% discount to our below Peer Table’s 78-company gold explorer peer group median market cap/oz AuEq of $21/oz.

April 2025 Parbec Gold Deposit MRE (Source: Renforth Resources)

11 Apr 2025

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.