- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 12 Sept 2025

Weekly Metals Mining Rundown for Week Ending 12 Sept 2025

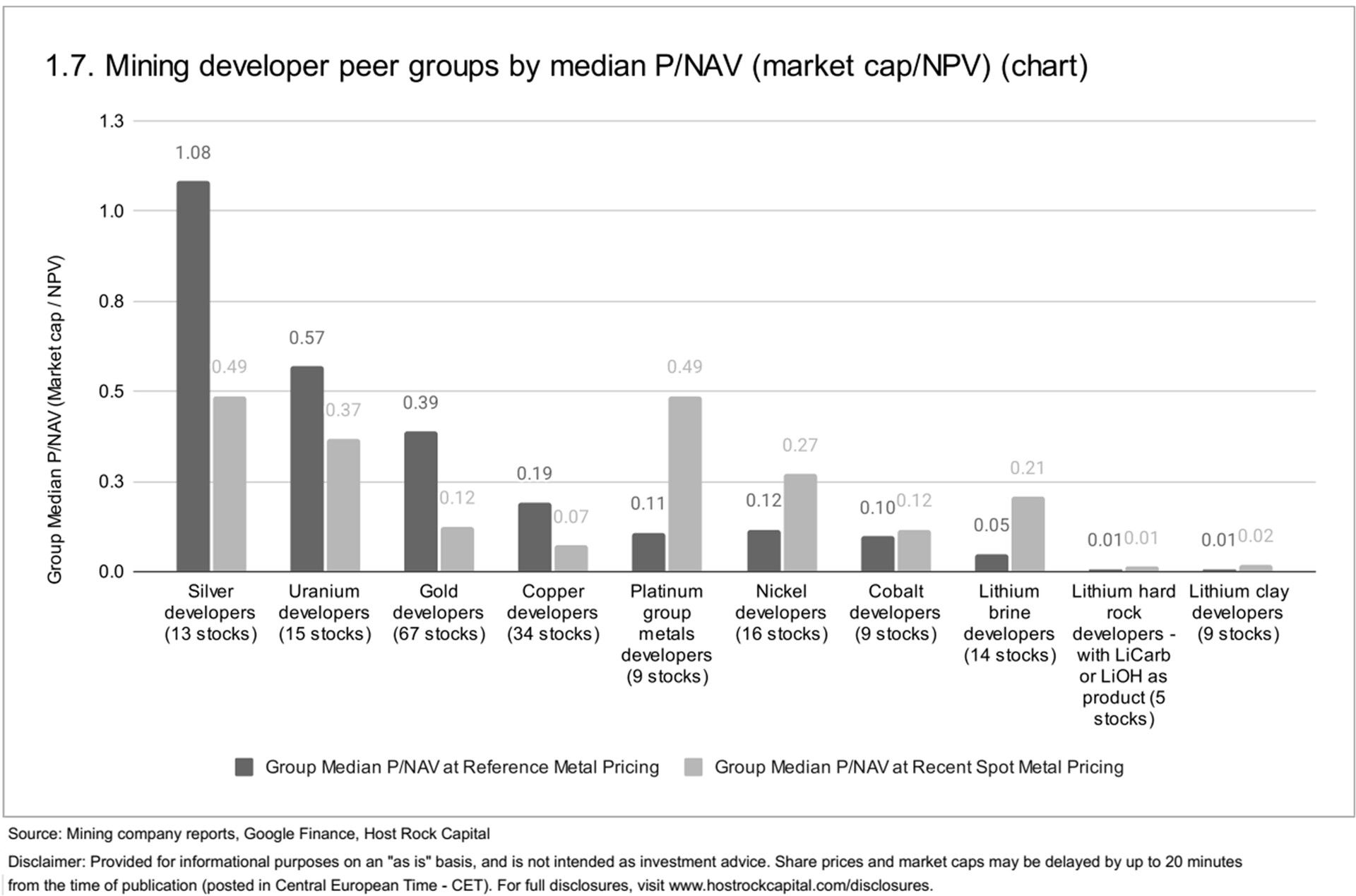

Silver and copper prices rose more than 2% this past week, with platinum, gold, and nickel also inching higher; Silver and gold stocks stood out among metals miners with some structural looking gains, and most lithium clay explorers rose sharply; Covered announcements include upgraded scoping study by Tesoro Gold (ASX:TSO) and merger by Anglo American (LON:AAL) and Teck Resources (NYSE:TECK).

This past week’s top & bottom metal price and mining company peer group movers include:

12 Sept 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 486) include (share price rounding errors apply, as sourced from Google Finance):

Covered mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership):

11 Sept 2025 - Gold developer Tesoro Gold (ASX:TSO) announced the outcome of a scoping study for its 90%-owned flagship El Zorro open pit project in Chile, which more than doubled total mill throughput to 40.7 Mt @ 1.02 g/t Au (was 17.1 Mt @ 1.25 g/t Au) since the 2023 Phase 1 scoping study. Reported all-in-sustaining-costs were low at $1,216/oz Au. And economics improved sunstantially compared to 2023 study due to the much larger project, to a post-tax NPV7.5 of US$663m at $2,750/oz from initial capital of $248m (includes $41m capitalized pre-strip), which rises substantially to $966m at TSO’s reported spot case of $3,330/oz Au. TSO stock rose +9% on 11 Sept following this news, before closing the week ending 12 Sept +25% (vs. gold developer group median +7.3%) to 5.3c/sh and market cap A$m. At our estimated 3-month trailing average gold price of $3,350/oz, and according to the metal price sensitivity analysis provided in the release, TSO’s NPV rises to $894m (was $619m with old 2023 study) and P/NAV (market cap/NPV) now trades at 0.08x at TSO price of 5.3c/sh - a 36% discount to our 67-company gold developer peer group median 0.12x. And it’s still early days for this project which is still growing fast. Not only is this Ternerra open pit deposit at El Zorro still open within the existing pit shell, underground potential beneath the open pit deposit has also already been identified, and this Ternerra deposit is “the first of multiple deposits capable of contributing to a signficantly larger future operation,” as stated by management in the release.

9 Sept 2025 - Cu-Ni-PGM producer Anglo American (LON:AAL) and Cu-Ni producer Teck Resources Limited (NYSE:TECK) announced a merger of equals to form a global critical minerals powerhouse, with 70% of its production exposure coming from copper (according to press release). Teck shareholders will receive 1.331 shares AAL per share TECK for a ~17% premium to TECK’s prior share price, with (all but 1%) of the premium being repaid to AAL shareholders by AAL in a special $4.5b dividend. Reported pre-tax annual recurring synergies are US$800m plus an additional $1.4b annually beyond 2030. Former Teck had a high 64% of it resource metal value coming from copper (and decent amount of nickel), whereas Anglo also has nickel but had been more diversified into PGMs and gold than Teck. Together this new Anglo Teck create’s a ~US$60b market cap bohemoth with 51% of its resource metal value coming from copper (diversified with PGMs+Au), joining the likes of top copper producers Glencore (LON:GLEN, mtk cap US$48b) and Freeport-McMoRan (NYSE:FCX, mkt cap $63b) - each of which (all 3) have some quarter trillion pounds in the ground of copper resources (BHP has nearly half a trillion pounds in ground copper, but it is more diversified into non-metals than these 3, with iron ore making up its largest revenue share at $28b in 2024). Pure-play copper producer FCX (with 80% of resource metal value coming from copper, rest Ag-Au) has been dominant trading (on 12 Sept) at market cap/lb resource of US$0.22/lb CuEq ($0.28/lb Cu) vs. GLEN’s (12 Sept) $0.10/lb CuEq ($0.18/lb Cu) and new proforma Anglo Teck’s US$0.11/lb CuEq ($0.21/lb Cu) - a 18% discount to 23-company copper producer median $0.132/lb CuEq. Should copper prices dip in near term and knock FCX off it’s dominant pedistal (in terms of market cap/lb CuEq resource), this new Anglo Teck should be well equipped to rise to the top spot (of these 3) with its PGM+Au diversification, provided PGMs+Au continue to outperform. GLEN on other hand is similarly diversified with 54% of its value of metal in ground coming from copper, but with other metals Co-Zn-Pb-Ag…GLEN could instead overtake FCX on market cap/lb if this basket of seconadary metals instead outperforms more than Anglo Teck’s PGMs +Au. Both stocks rose following this announced deal, with AAL closing week ending 12 Sept up +13%, and TECK up +22% (vs. copper producer median gain of 4.7%).

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.