- Weekly Metals Mining Rundown - Free

- Posts

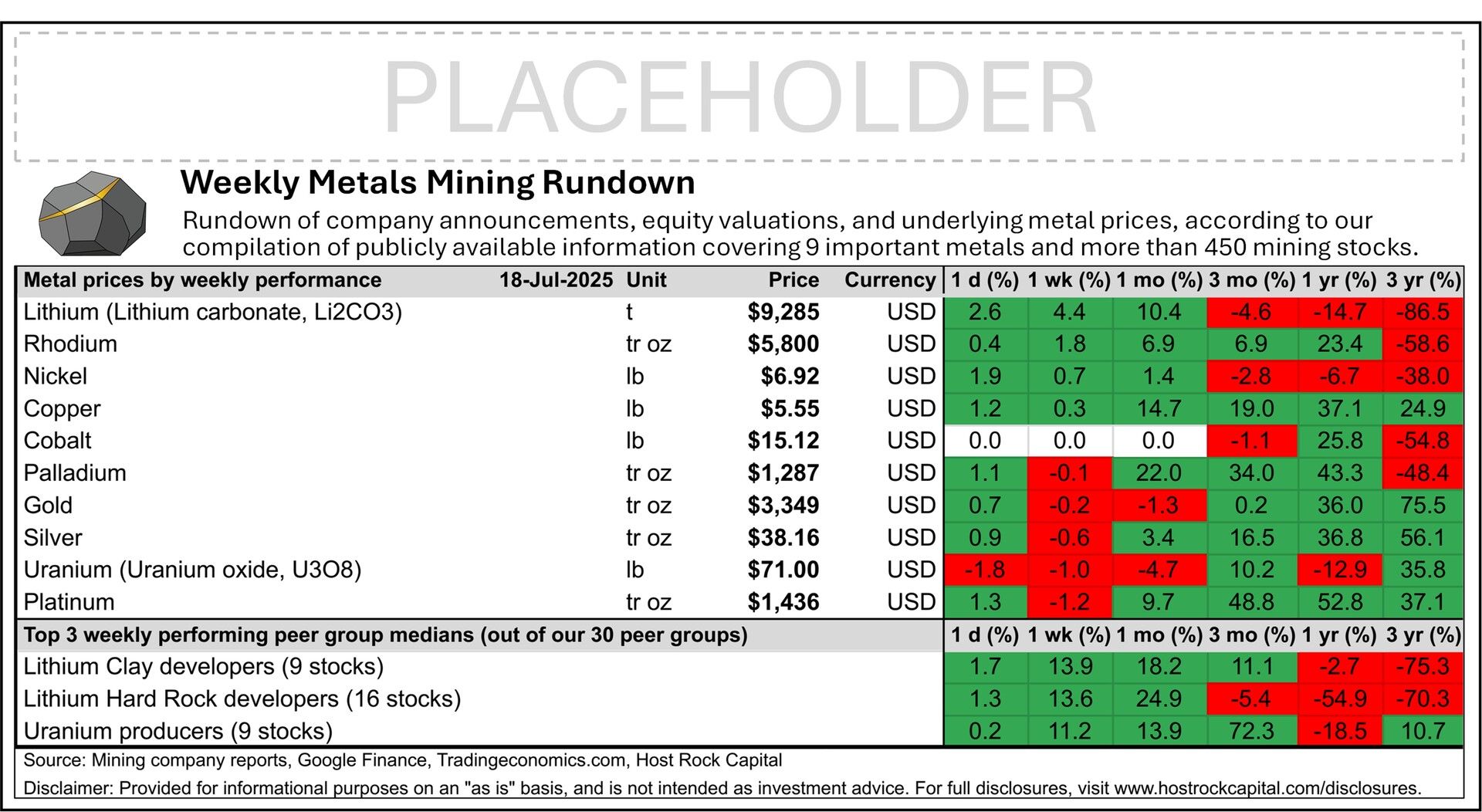

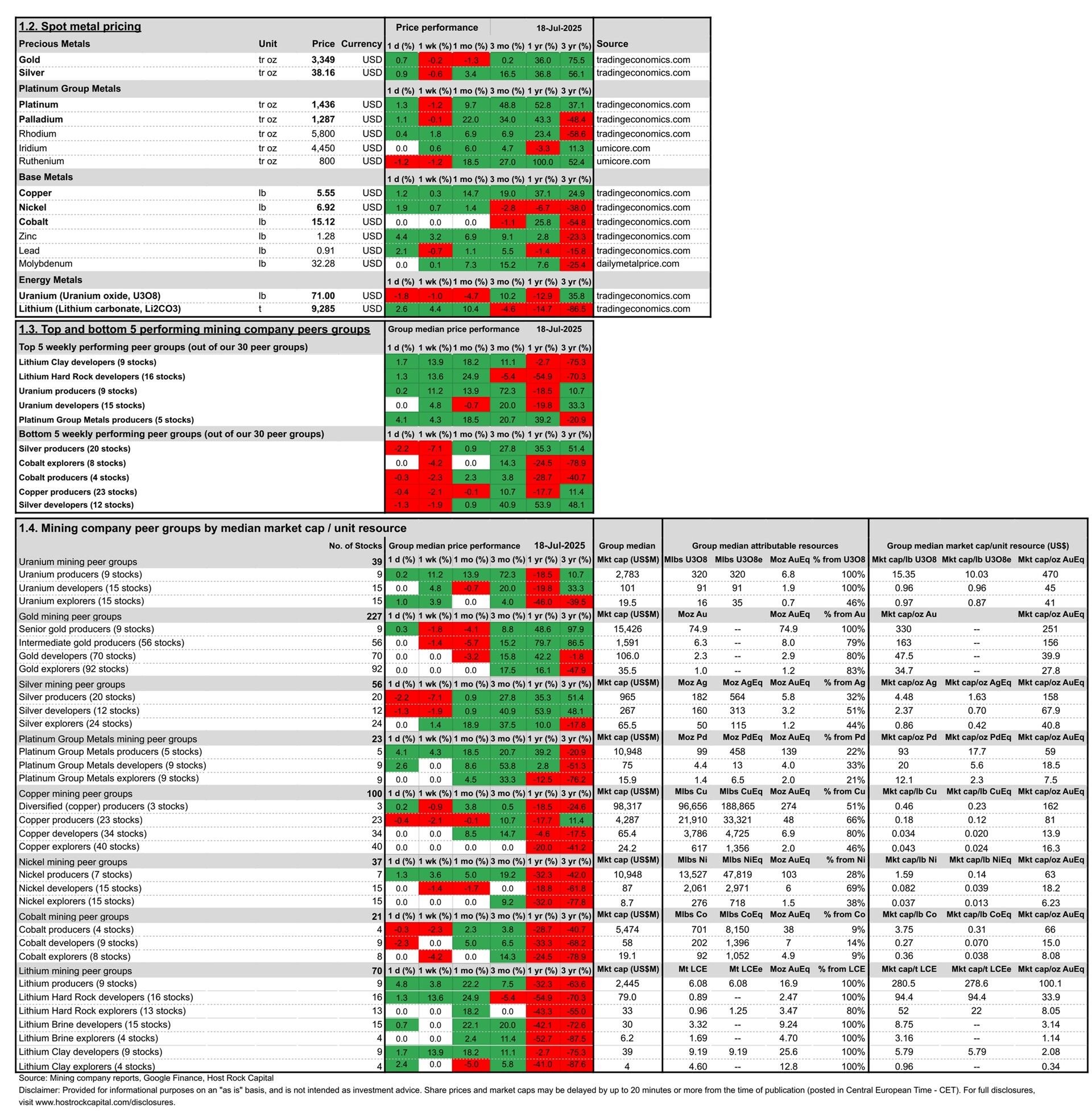

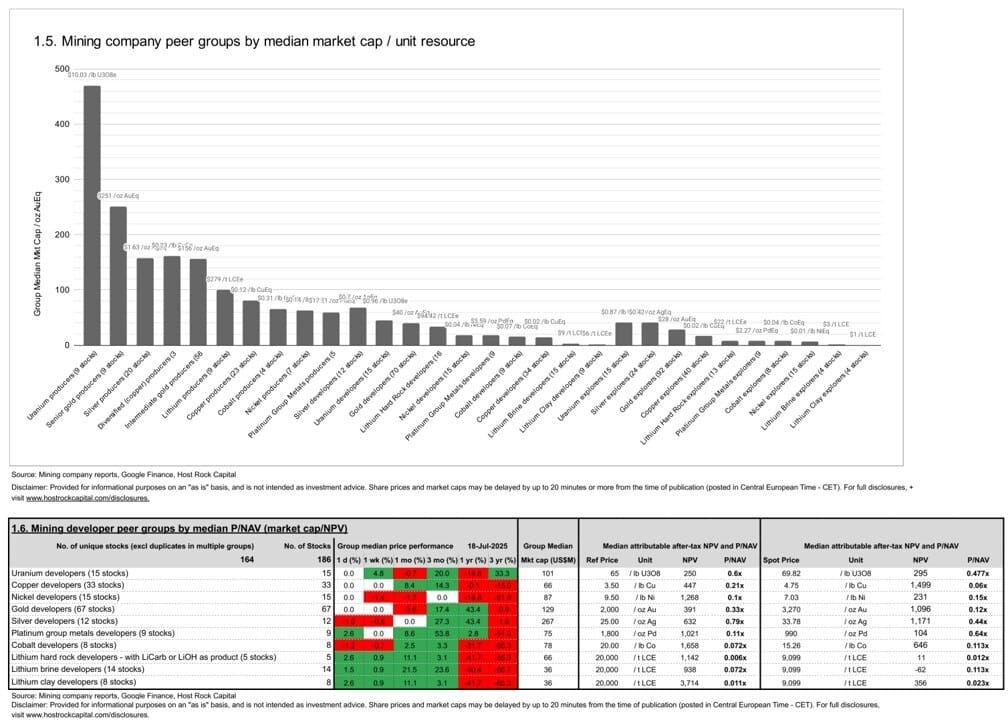

- Weekly Metals Mining Rundown for Week Ending 18 July 2025

Weekly Metals Mining Rundown for Week Ending 18 July 2025

Lithium price closed the week +4% higher, coinciding with gains made in larger-cap lithium mining stocks; Uranium stocks also gained - similarly led by larger-caps, while uranium spot price dipped slightly

This past week’s top & bottom metal price and mining company peer group movers include:

18 July 2025

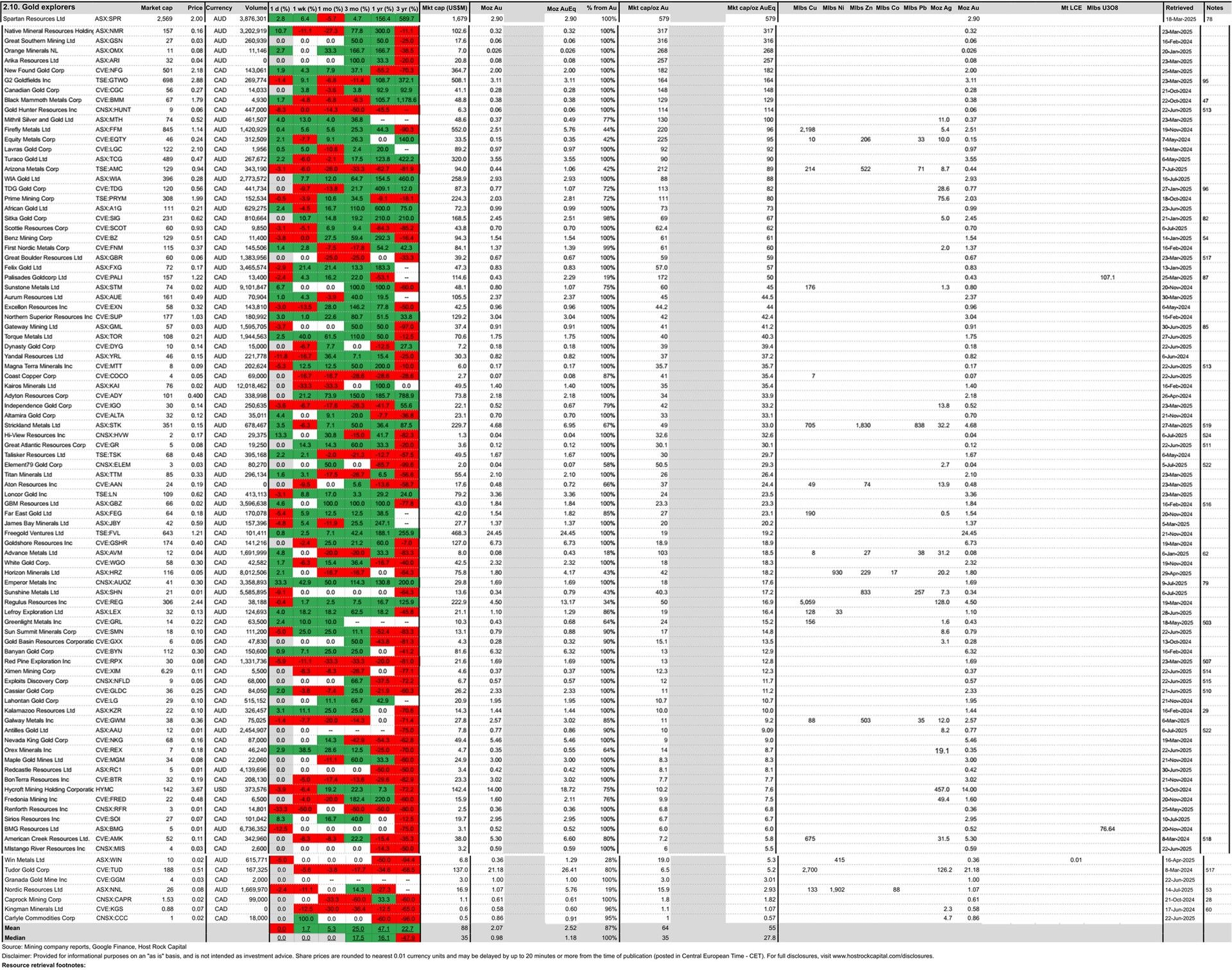

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 488) include (share price rounding errors apply, as sourced from Google Finance):

Covered metals mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

18 July 2025 - Nickel and Cobalt developer Lifezone Metals (NYSE:LZM) made two separate announcements: Filing of feasibility study (FS) for flagship Kabanga project in Tanzania, and further consolidation its ownership in the project to 84% from 69.7% according to a definitive agreement with BHP Bilton UK, with the remaining 16% of project being held by the Tanzanian government. The feasibility study further de-risks this top tier nickel developer and replaces the recent 2025 IACF (Initial Assessment of Cash Flows) in our Peer Table. LZM’s attributable after-tax NPV (at our reference nickel price of US$9.5/lb according to the metal price sensitivity provided in the FS) was US$1.7b, which trades at a P/NAV (market cap/attributable post-tax NPV) of 0.20x - just above nickel developer median 0.10x and still well below mean 0.33x (also at our reference nickel price of $9.5/lb).

18 July 2025

17 July 2025 - Gold developer Carnavale Resources (ASX:CAV) announced a resource update for its flagship Kookynie gold project in West Australia, which grew contained gold ounces by 38% to 117 koz Au (grading fairly high at 4.3 g/t) which are split between an open pit portion and an underground portion, and include a bonanza zone of 55 koz grading 28.3g/t Au. The update paves the way for an updated scoping study due in the coming weeks. CAV and its 117 koz resources trade at a week ending (18 July) market cap of A$16m and market is around the upper quartile range (~75-percentile) of our 71-company gold developer peer group. On P/NAV (taken as market cap/70% of pre-tax NPV) according to the results of the (now superseded) 2024 Scoping Study that was based on the initial resource of only 85 koz, CAV trades at (P/NAV) 0.34x at our reference gold price of US$2,000/oz - in-line with our gold developer median 0.33x and well below mean 0.56x (also at reference gold price $2,000/oz).

18 July 2025

18 July 2025

16 July 2025 - Gold explorer WIA Gold (ASX:WIA) announced a resource update for its flagship Kokoseb gold project in Namibia, which grew contained gold ounces by 38% to 2.93 Moz Au @ 1.0 g/t and paves the way for a scoping study that is underway. This decent grade and large size with a strip ratio that also looks decent (appears to be roughly 3 or 4 by visual inspection of cross section) should bode well for economics in the upcoming scoping study, which helps WIA trade at premium to most peers - around the upper-quartile-range of our 93-company gold explorer peer group - at a (18 July) market cap/oz of US$88/oz, as it advances towards graduating to developer peer group with scoping study underway now, and then with a DFS in 2026.

18 July 2025

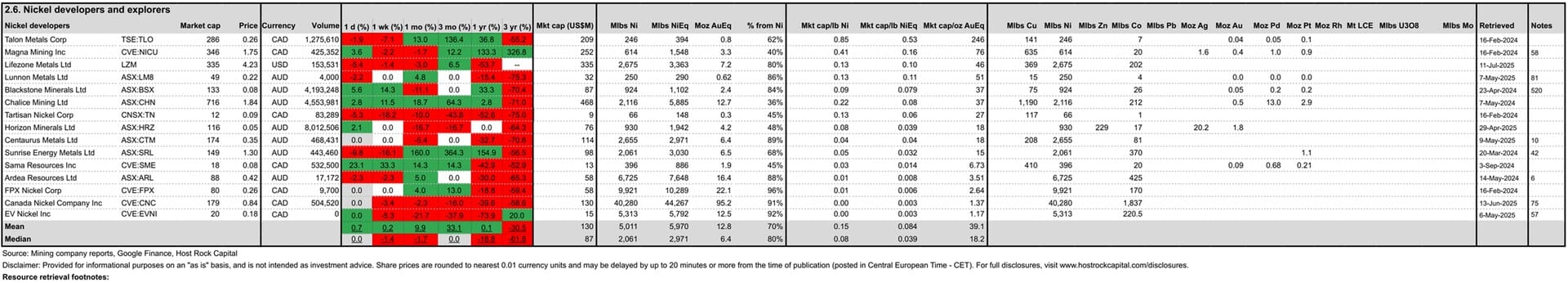

15 July 2025 - Nickel and cobalt developer Canada Nickel Company (TSXV:CNC) announced initial resources at its 80%-owned Mann Central project and 100%-owned Textmont project, both in Ontario. These account for the 5th and 6th deposits uncovered by CNC across its Timmins Nickel District. Mann Central resource contained 1.1Blbs Ni @ 0.22% Ni and 62Mlbs Co @ 0.012% Co (indicated) and 2.5Blbs Ni @ 0.21% Ni and 145Mlbs Co @ 0.012% Co (inferred), which are 80% attributable to CNC, and the estimate also included an exploration target to further double to triple this. Textmont resource contained a higher-grade 240Mlbs Ni @ 0.29% Ni and 9.5Mlbs Co @ 0.011% Co (measured and indicated) and 317Mlbs Ni @ 0.25% Ni and 13Mlbs Co @ 0.011% (inferred). Thes two new deposits grows CNC’s combined attributable resources by ~18% to 44.3 Blbs NiEq (91% from Ni, 9% Co), but CNC stock traded surprisingly flat on 15 July after this news +0% to C$0.86/sh, before finishing the week (ending 18 July) down -3.4% (vs. gold developer median decline of -1.4%) to a basic market cap (assuming 213.25m basic shares post completion of recent financings) of C$179m and market cap/lb resource of US$0.003/lb NiEq or $0.007/lb CoEq ($1.37/oz AuEq) for this largest-in-class inventory of nickel resources - a 92% discount to our 15-company nickel developer peer group median US$0.039/lb NiEq ($18.2/oz AuEq) and a 91% discount to our 9-company cobalt developer median $0.070/lb CoEq ($15/oz AuEq). On P/NAV from flagship Crawford 2023 feasibility study at our reference nickel price of US$9.5/lb Ni, CNC trades at (market cap/post-tax NPV) of 0.053x - a 49% discount to nickel developer group median 0.10x.

18 July 2025

18 July 2025

14 July 2025 - Nickel, cobalt, and gold explorer Nordic Resources Ltd (ASX:NNL) announced a maiden JORC resource estimate for its Hirsikangas (264 koz Au @ 1.13g/t) that grew its Middle Ostrobothnia/Central Finland gold asset JORC resources by 34% to a reported 1.23 Moz AuEq @ 1.11g/t AuEq (including contained gold of 1.04 Moz Au @ 0.95 g/t Au). The resource update used a cut-off grade of 0.3g/t Au and resulted in 28% more tonnes and 16% more contained gold-equivalent versus a comparable historic 2009 MRE (that used a higher 0.5 g/t cut-off), while only compromising a 10% drop in grade. Including NNL’s vast nickel-cobalt resources in northern Finland, NNL now hosts mineral resources of 5.76 Moz AuEq or 2.68 Blbs NiEq (now 19% from Au, 71% from Ni, 13% from Co, rest Cu - at our estimated 3-month trailing average metal prices with no recovery factors). NNL stock traded up +6% on 14 July (vs. ASX gold explorer mean performance of +2.5%) following this news to A$0.09/sh, before closing the week (ending 18 July) up down ~10% to A$0.08/sh, market cap (pro-forma including pending shares from cap raise) of A$26m, and (proforma) market cap/oz resource of US$2.93/oz AuEq ($0.006/lb NiEq) - a wide 89% discount to our 92-company gold explorer median market cap $27.8/oz AuEq.

18 July 2025

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.