- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 19 Dec 2025

Weekly Metals Mining Rundown for Week Ending 19 Dec 2025

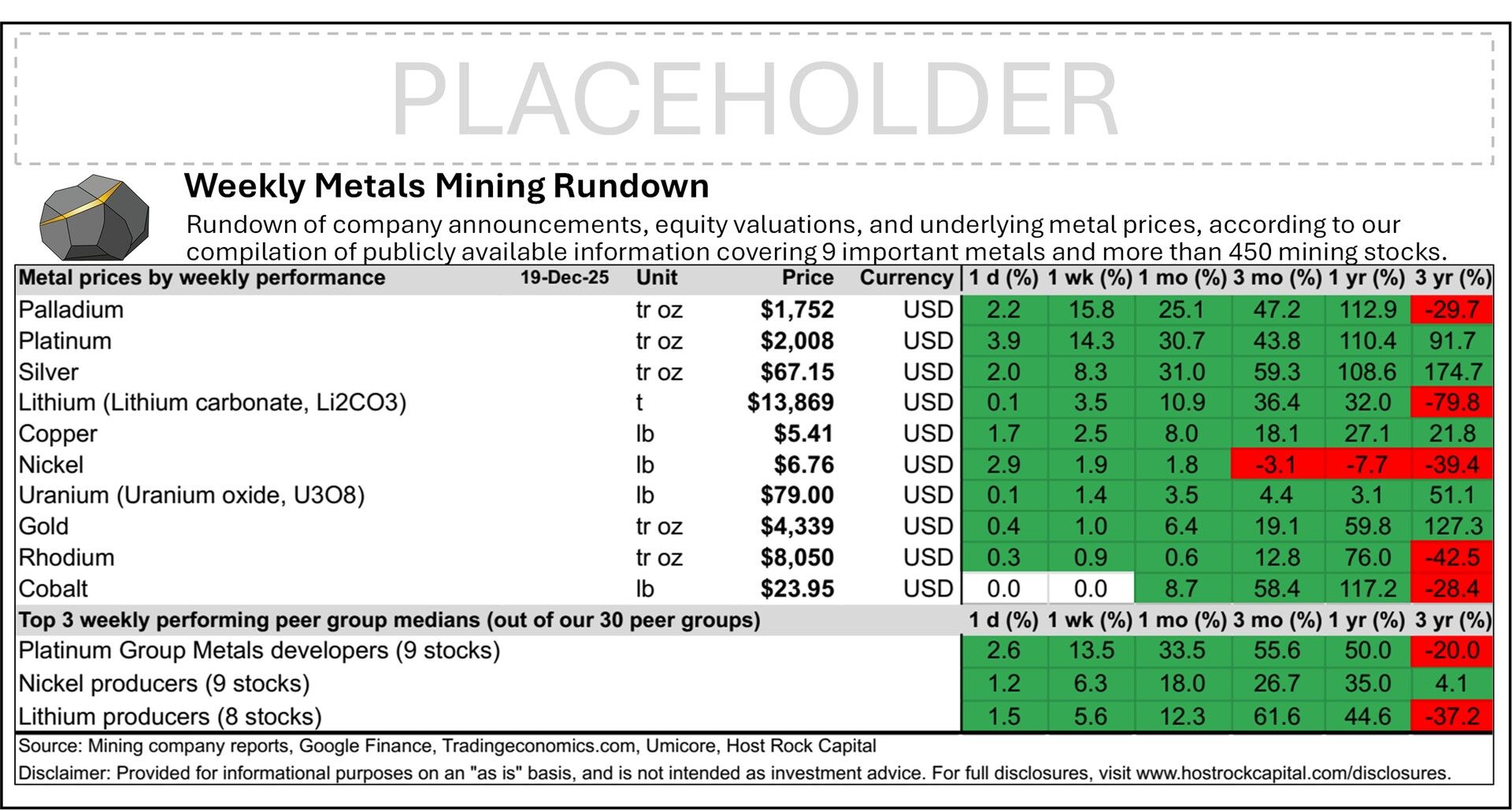

PGM prices SURGED this past week +15% to over $2,000/oz Pt and $1,750/oz Pd, which translated to double-digit gains for most PGM developer stocks and multiple percent gains for most PGM producers; Silver price also jumped +8% this week to new all time high $67/oz, while other metals lithium, copper, nickel, uranium, gold, and rhodium also inched higher, translating to slight upticks in most metals mining stocks.

This past week’s top & bottom metal price and mining company peer group movers include:

19 Dec 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 503) include (share price rounding errors apply, as sourced from Google Finance):

No mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership).

Gold developer (and new gold producer) Hemlo Mining Corp. (TSXV:HMMC) on 18 Dec announced its first gold pour at its Hemlo gold mine in Ontario, after just completing the acquisition from Barrick Mining Corporation less than one month ago. Hemlo has a 2024 PFS prepared by large consulting conglomerates SLR Consulting and WSP which employ some 4,500 and 75,000 people globally (none of whom caught the glaring error/discrepancy between the base case gold provided in Table 1-2 of the PFS which was 2,780/oz, and the one provided in the NPV sensitivity in Table 22-2 which was $2,610/oz – plz fix). HMMC stock has gained +33% over the past week (vs. developer average gain of +4%), to C$5.36/sh (18 Dec intraday), market cap C$1.6b, P/NAV (market cap/NPV) of 0.52x at 3-month trailing gold price US$3,914/oz (assuming PFS base case gold price was $2,780/oz per Table 1-2) – which is around the upper-quartile range of our 73-company gold developer peer group, but looks QUITE CHEAP given this mine (and mill) is ALREADY BUILT and has been producing since November 26th (and is well on its way to achieving full-scale commercial production and mid-tier gold producer status, which would typically warrant a higher P/NAV in the ballpark of 0.6-1x).

19 Dec 2025

Gold developer (with growing small-scale production) Heliostar Metals Ltd (TSXV:HSTR) announced last week (on 11 Dec) an updated PFS for its large, 100% owned Cerro del Gallo project in Mexico, which is next in-line for development after its (also-large, flagship) Ana Paula project - all in Mexico where HSTR holds another project (San Antonio) and 2 past-producing/operating mines with growing small-scale gold production (La Colorado and San Agustin) - for 5 projects/mines in total, all with recent economic studies including NPVs. This announced Cerro del Gallo PFSU reported an after-tax NPV5 of US$424m at US$2,300/oz Au from initial capex of only US$195.3m for heap leach mine. This NPV is slightly lower than in the 2020 PFS (at apples-to-apples metal pricing), but cost estimates and mine plan are now updated/tightened. Combined post-tax NPV for all 5 projects at 3-month trailing average gold price US$3,914/oz stands at US$3,709m, and based on a (basic) HSTR market cap of US$544m, stock trades at P/NAV 0.15x - exactly in-line with our 72-company gold developer group median 0.15x (but HSTR actually has growing small-scale production from ongoing operations unlike most other developers in this group, so this P/NAV should continue to rise, ultimately reaching 0.6-1x upon achieving mid-tier gold producer status).

Former nickel and copper developer – now copper and nickel producer – Talon Metals Corp. (TSXV:TLO) today (19 Dec) announced the acquisition of producing Eagle Mine and nearby Humboldt Mill in the Upper Peninsula of Michigan, from Copper producer Lundin Mining Corporation (TSX:LUN). Consideration will be 275.15m shares TLO representing 18.73% of the company after a US$5.6m concurrent private placement with Lundin Family Trust for another 1.26%, with Lundin Mining to own 19.99% after the (small) position it already held. These 275.15m shares translate to a value of C$115.6m at yesterday’s (18 Dec) closing TLO share price of C$0.42. TLO enjoyed a premium valuation (market cap had been C$481m or US$0.84/lb NiEq resource) for its 51% interest in PEA-stage high-grade Tamarack Ni-Cu project in Minnesota, where earlier this year it discovered a major extension (Vault Zone) to the Tamarack Ni-Cu(-Co-PGM-Ag-Au) system that is not yet in resources. And the company is now leveraging this premium to graduate to the producer peer group by adding Eagle, from which cash flows can be used to help fund development activities at Tamarack. Including the concurrent private placement, TLO’s basic shares will grow by ~25% to 1.46 B shares (before a planned share consolidation) and its attributable NiEq resources will grow by ~18% (from Eagle) to ~585 Mlbs NiEq (~50% from Ni, 34% from Cu, rest Co, Ag, Au, Pd, Pt). TLO stock traded up +35% intraday (19 Dec), before closing the week (ending 19 Dec) up +33% to C$0.56/sh, proforma market cap C$819m, and proforma market cap/lb US$1.20/lb NiEq or $0.85/lb CuEq – at the top of our 24-company copper producer peer group (pending the future addition of Tamarack’s new Vault zone to resources, which management suggests has geometry, scale, and copper enrichment up to 4x greater than what’s in Tamarack's resource area).

19 Dec 2025

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.