- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 19 Sept 2025

Weekly Metals Mining Rundown for Week Ending 19 Sept 2025

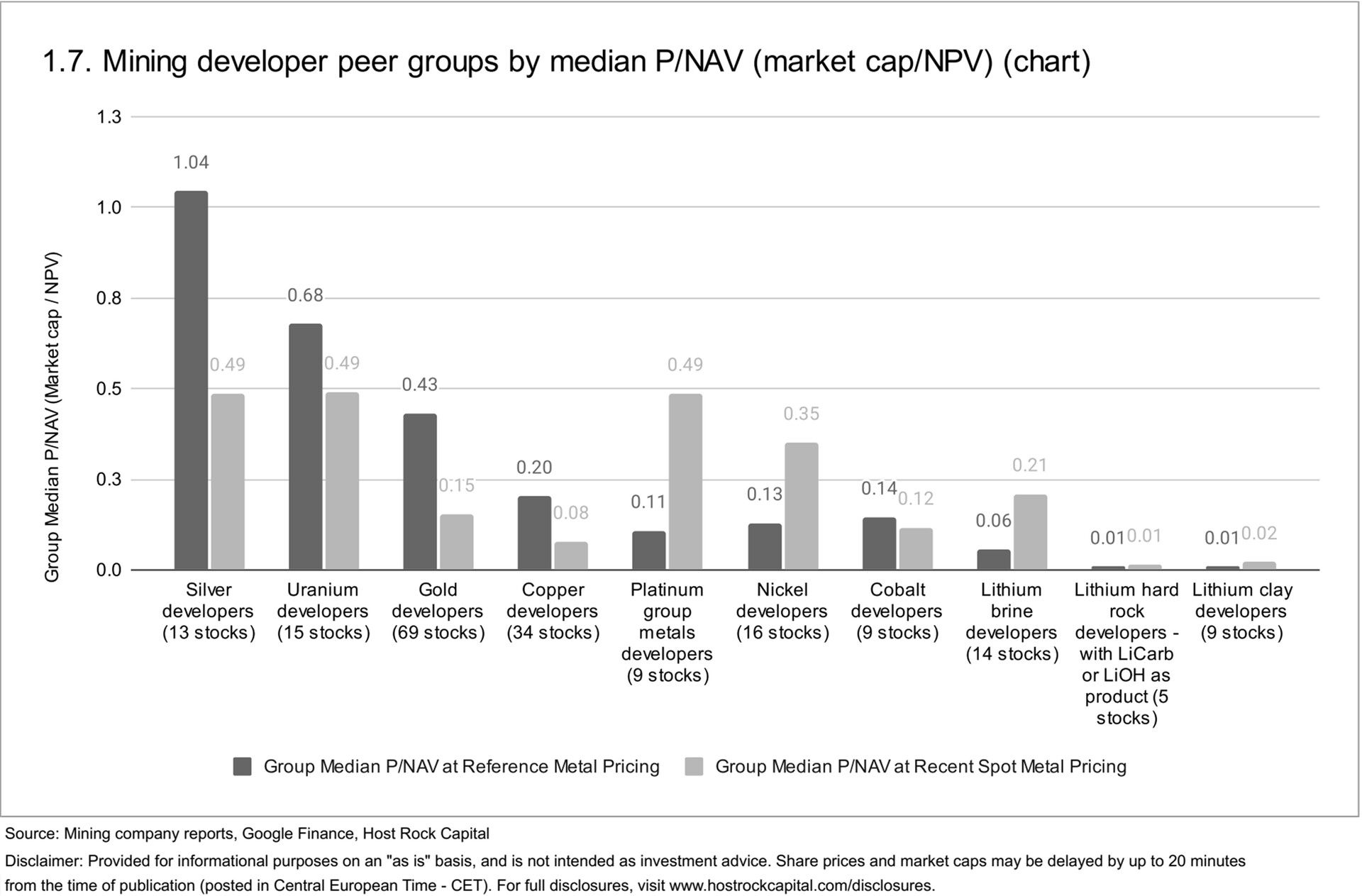

Silver price led the metals for second week straight, rising another 2.2% to over $43/oz after breaching $42/oz just last week. Lithium, uranium, platinum, and gold also each rose more than 1% with gold around all-time-highs; Most mining stocks rose across the metals complex, led by larger cap uranium stocks; Fuerte Metals acquired Coffee, resource update by Arizona Sonoran Copper, and First Nordic and Mawson Finland consolidate their leadership under new chairman and CEO in merger.

This past week’s top & bottom metal price and mining company peer group movers include:

19 Sept 2025

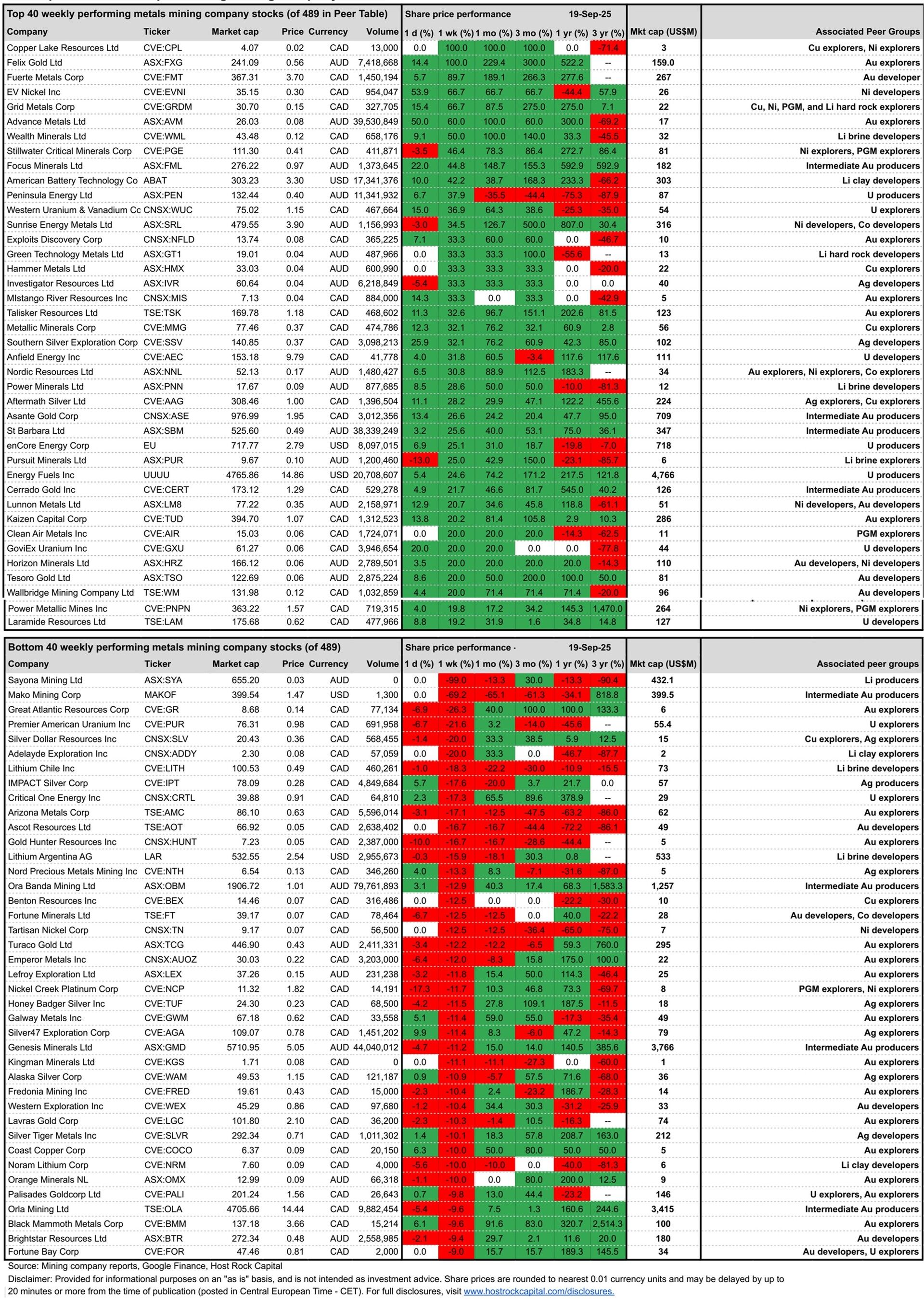

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 489) include (share price rounding errors apply, as sourced from Google Finance):

Covered mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership):

15 Sept 2025 - Former gold (and Cu, Ag) explorer - now gold developer - Fuerte Metals (TSXV:FMT) announced the acquisition of the Coffee gold project in Yukon from Newmont Corporation (NYSE:NEM) for up to US$150m ($10m cash, $40m stock, and a 3% royalty that can be repurchased for $100m). Project has a new M&I resource of 3Moz @ 1.15 g/t and 0.8Moz inferred @ 1.17 g/t. FMT’s basic shares outstanding will nearly triple to ~99.3m for the $40m share payment to NEM combined with a concurrent $50m private placement of subscription receipts at C$1.65/sh led by Stifel and BMO. FMT stock rose roughly 90% this week ending 19 Sept following the announcement, to C$3.70/sh, and proforma market cap C$367m, which equates to a P/NAV (taken as pf market cap/post-tax NPV) of 0.27x at our reference gold price $2,000/oz (if we dust off the old/outdated 2016 Kaminak Resources Feasibility Study), which is still a 38% discount to our 68-company gold developer peer group median 0.43x (at $2,000/oz).

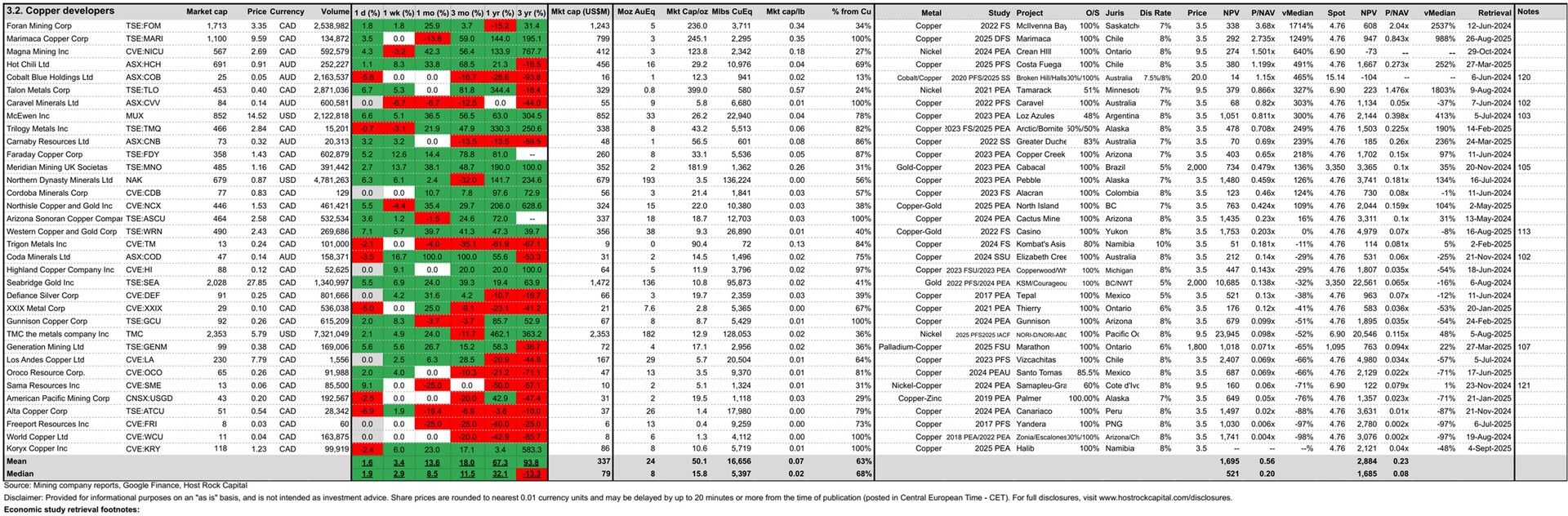

16 Sept 2025 - Copper developer Arizona Sonoran Copper Company Inc. (TSX:ASCU) announced a resource update for its flagship past-producing Cactus mine project in Arizona, which grew M&I resource by 50% to 11 Blbs Cu and total M&I&I resources by 14% to 12.7 Blbs, 75% of which is leachable with remaining 25% consisting of sulfides, and which paves the way for a maiden reserve and PFS due Q4/25 (following a PEA last year). ASCU stock traded up a slight +1.2% vs. peer group median gain +2.9% this week ending 19 Sept following this news, to a market cap/NPV (P/NAV) of 0.23x at our reference copper price US$3.50/lb - just above our 34-company copper developer median 0.20x and well below mean 0.56x.

15 Sept 2025 - Gold explorer First Nordic Metals (TSXV:FNM) announced a merger with gold developer Mawson Finland Limited (TSXV:MFL) to create a leading Nordic gold development (and exploration) company. Importantly, leadership will be consolidated under a new incoming chairman and new CEO - both veterans with decades of experience working together. Incoming Chairman Peter Breese has over 35 years experience with a specialty in building and operating mines - including as President and CEO of Asanko Gold (now Galiano Gold TSX:GAU) through financing, construction, and comissioning of the Asanko Gold Mine in Ghana - on time and within budget. And new CEO and incoming director Russell Bradford is a metallurgist and seasoned mining executive with over 35 years of project management and operational experience - including for several tier-1 companies, including Anglo American. And most recently Mr. Bradford served as Managing Director of Aston Minerals which he merged with Torque Metals in 2025. And Darren Morcombe also joins as Special Advisor - mining executive based in Switzerland with over 30 years international experience across mining finance, operations, and corporate leadership. MFL shareholders will receive 7.1534 shares of NordCo (FNM proforma) before a concurrent 4-to-1 consolidation, resulting in a ~23% premium to Friday (12 Sept) closing prices of C$2.68/sh (MFL) and C$0.46/sh (FNM), before (~11.5%) dilution from a C$30m concurrent non-brokered subscription receipt financing. MFL stock was up +2.6% intraday (15 Sept) following this news before closing day down 7% (on 2x avg volume, before rising 13% the next day (16 Sept) on 7x avg volume after our note on LinkedIn here. FNM had traded (on Friday 12 Sept before announcement) at market cap/oz AuEq resource of US$74/oz - which had been around the 65th-percentile of our 90-company gold explorer peer group (between median $39/oz and mean $78/oz). But now FNM (NordCo) add’s development stage Rajapalot project in Finland with a 2023 PEA (to its existing 45%-owned Barsele project in JV with Agnico Eagle within Sweden’s Gold Line Belt, and Kylmakangas project in Finland’s Oijarvi Greenstone Belt - both resource stage) and graduates to our gold developer peer group, and traded on 15 Sept at proforma market cap/oz resource of US$70/oz AuEq (after stock fell -14% intraday) before stock closed the week (ending 19 Sept) flat +0% at C$0.46/sh, proforma market cap C$256m or US$81/oz AuEq, which is only ~60th-percentile of our 73-company gold developer peer group, which also has step change higher median and mean market caps/oz of US$54/oz and $88/oz. And FNM maintains its aggressive exploration plans for 2025-2026 of 15-20,000m/yr across its Sweden’s Gold Line belt, with 3,500m at Barselle JV, while MFL’s side will continue its permitting and engineering as it targets strategic project status according to EU’s CRMA (for Rajapalot’s cobalt byproduct).

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.