- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 29 Aug 2025

Weekly Metals Mining Rundown for Week Ending 29 Aug 2025

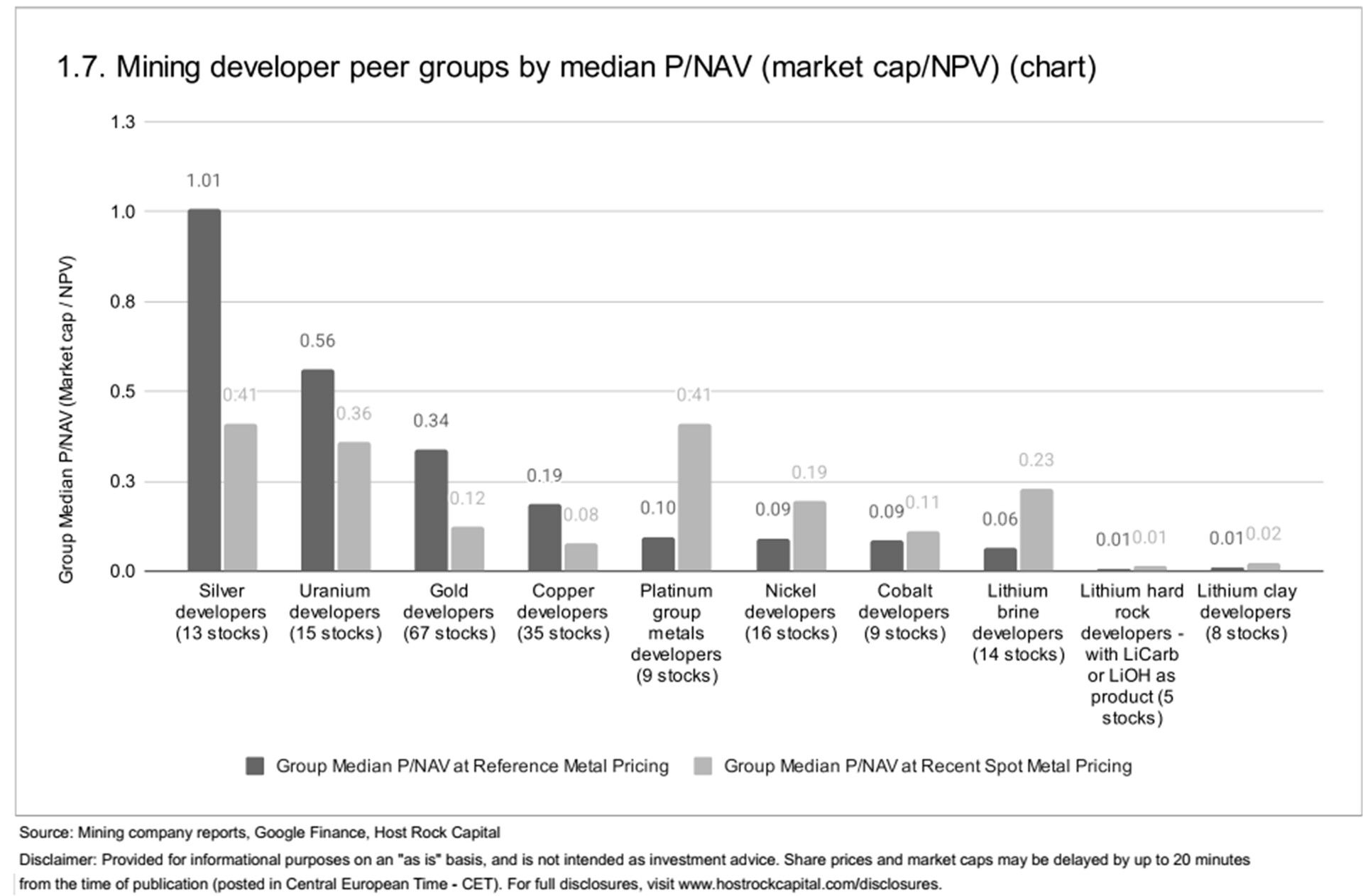

Most metal prices rallied this past week, led by uranium, nickel, gold, and silver rising more than 2%; Mining stocks also broadly gained, with cobalt developers standing out despite stagnant $15/lb pricing.

This past week’s top & bottom metal price and mining company peer group movers include:

29 Aug 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 488) include (share price rounding errors apply, as sourced from Google Finance):

Covered mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

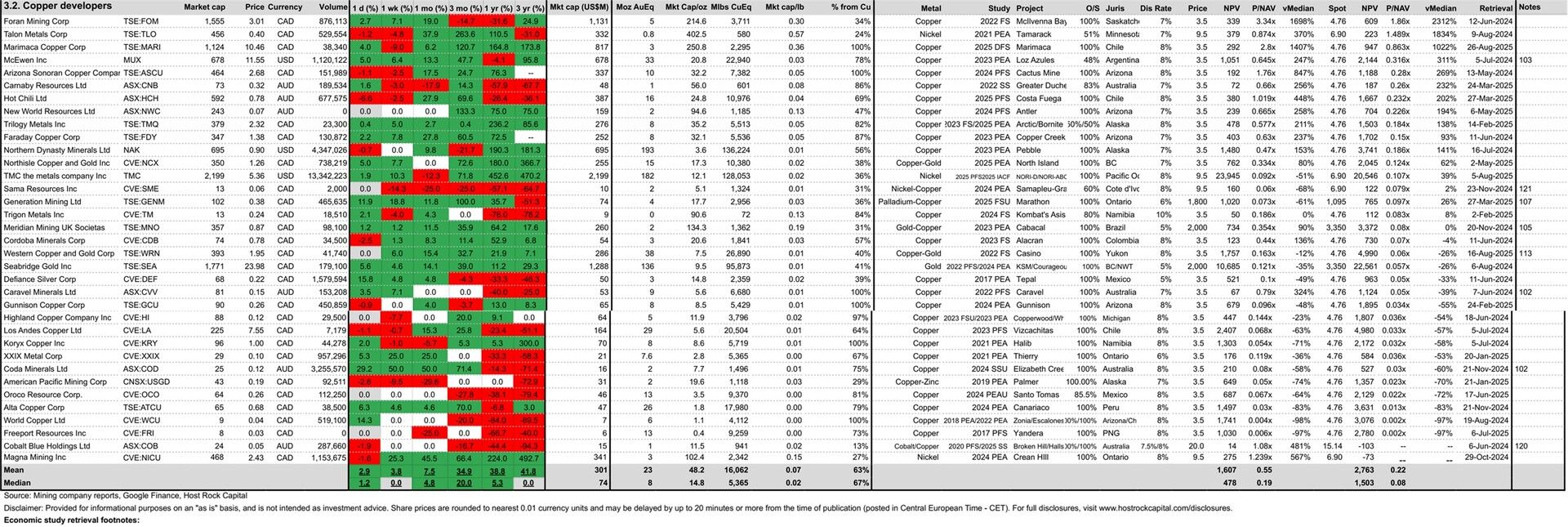

25 Aug 2025 (after-market) – Copper developer Marimaca Copper (TSX:MARI) announced feasibility study results for its flagship 2.3 Blbs Marimaca pure-play copper project in Chile, delivering outstanding results overall and a world class copper open pit head leach project with capital intensity among the best in its class, and low all-in-sustaining-costs just above the lower-quartile-range of global peers and well below the median. Study contemplated production of 50 ktpa Cu from a 179Mt reserve grading 0.42% Cu with a super low waste-to-ore strip ratio of 0.82 (meaning more ore than waste), which did not incorporate inferred resources accounting for ~28% of the deposit’s contained copper, nor did it incorporate any the potential from Pampa Medina (and Madrugador) satellite deposit where super high grades were recently reported from drilling including 6m of 12% Cu within 26m of 4.1% Cu (hole SMRD-13) for which there is a resource estimate and PEA underway now that management envisions could increase Marimaca’s production to as high as 70 ktpa. MARI appears serious about building this project, as it has signaled strong support by strategic shareholders Assore Group International Holdings and Mitsubishi Corporation Corp., and has recently optioned to acquire a sulfuric acid plant to provide low-cost acid for the heap leach process, and has submitted its permitting documentation for which it expects approval by end of 2025 in time for construction to start as early as 2026. Post-tax NPV8 was $709m at $4.30/lb Cu from initial capital of $587m, which came up shy of 2020 PEA results adjusted for same metal prices (according to metal price sensitivity in the PEA), as is usually the case on this key de-risking step up to feasibility stage and should have been expected by many investors (especially because the PEA was old). MARI stock had traded near the top of our 35-company copper developer pack (3rd from the top, behind only Foran Mining TSX:FOM and Talon Metals Corp. TSX:TLO) at a P/NAV (simplified as market cap/NPV) of 0.76x according to the 2020 PEA adjusted for our 3-month trailing average copper price of US$4.79/lb Cu (prior to announcement). But based on MARI’s 25 Aug close of C$11.44/sh, and according to the announced DFS results with a slightly lower NPV, MARI closed on 25 Aug at P/NAV of 0.91x. Based on this jump in P/NAV, and because some investors may not fully appreciate the importance of the de-risking step of this feasibility study, MARI stock fell some ~10% on these results before recoverying somewhat and closing the week ending 29 Aug down -9% to share price C$10.46, market cap C$1.1b, and P/NAV setlling around 0.86x (at our newly updated 3-month trailing copper price of $4.76/lb), as other investors continue to sieze the buying opportunity (presented by the sell off) in anticipation further derisking steps towards production, in addition to future cumulative additions to the project’s economics from the ongoing/pending PEA for Pampa Medina satellite deposit.

Source: Marimaca Copper

Source: Marimaca Copper

25 Aug 2025 - Gold developer Omai Gold Mines (TSXV:OMG) reported an updated mineral resource estimate (MRE) for its Wenot deposit at its 100%-owned Omai Gold project in Guyana, which more than doubled indicated resources to 3.7 Moz @ 1.82 g/t Au while also growing inferred resources by 16% to 0.97 Moz @ 1.46 g/t. Including the project’s other Gilt Creek deposit, project and company resources gres by ~50% to 6.5 moz. OMG stock was up a few percent on 25 Aug intraday following this news, to 90c/sh, before closing the week ending 29 August up +4.5% (in-line with gold developer medain gain +4.4%) top 92c/sh, market cap C$549m, and market cap/oz of US$61/oz Au - inbetween our 71-company gold developer peer group median $48/oz and mean $74/oz AuEq. Omai’s after-tax NPV5 according to its 2024 PEA (that is now superceded by this substantial resource update), is US$600m, translating to a P/NAV (taken as market cap/NPV) of 0.67x at our refernce gold price of US$2,000/oz - above group mean P/NAV of 0.58x. But a larger NPV to reflect this substantial resource upgrade (and at least one additional resource upgrade as 2 rigs continue to aggressively convert inferred resources to indicated) is anticipated by late 2026. Guyana returned to Fraser institutes survey of mining companies this year after being excluded last year, and it moved up +13 spots since the prior year to #9 - just ahead of Norway #10 and just behind Newfoundland #8 and Saskatchewan #7 (as we covered on LinkedIn here: https://lnkd.in/dATAkqjb).

25 Aug 2025 - Lithium producer Sayona Mining Limited (ASX:SYA) announced an updated JORC mineral resource and ore reserve estimates for its 60%-owned Moblan project in Quebec - located some ~500km away from 100% owned (after recently completing merger with Piedmont Lithium) North American Lithium mine where spodumene is currently being produced and exported. The overall deposit (M&I&I) grew by 30% to 121 Mt grading 1.19% lithium oxide, which increased the companies combined lithium resources by 15% to ~3.46 Mt Lithium carbonate equivalent (LCE). SYA stock was up +4% intraday 25 Aug following this news to 2.7c/sh, before closing the week ending 29 Aug flat +0% (vs. peer median up+1%) to 2.6c/sh, market cap A$655m (proforma, post merger with Piedmont and associated placement for basic proforma shares 25.2b SYA), and market cap/t LCE resource of US$90/t LCE ($31/oz AuEq) - an ~71% discount to our 8-company Li producer peer group median $309/t LCE ($108/oz AuEq).

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.