- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 5 Sept 2025

Weekly Metals Mining Rundown for Week Ending 5 Sept 2025

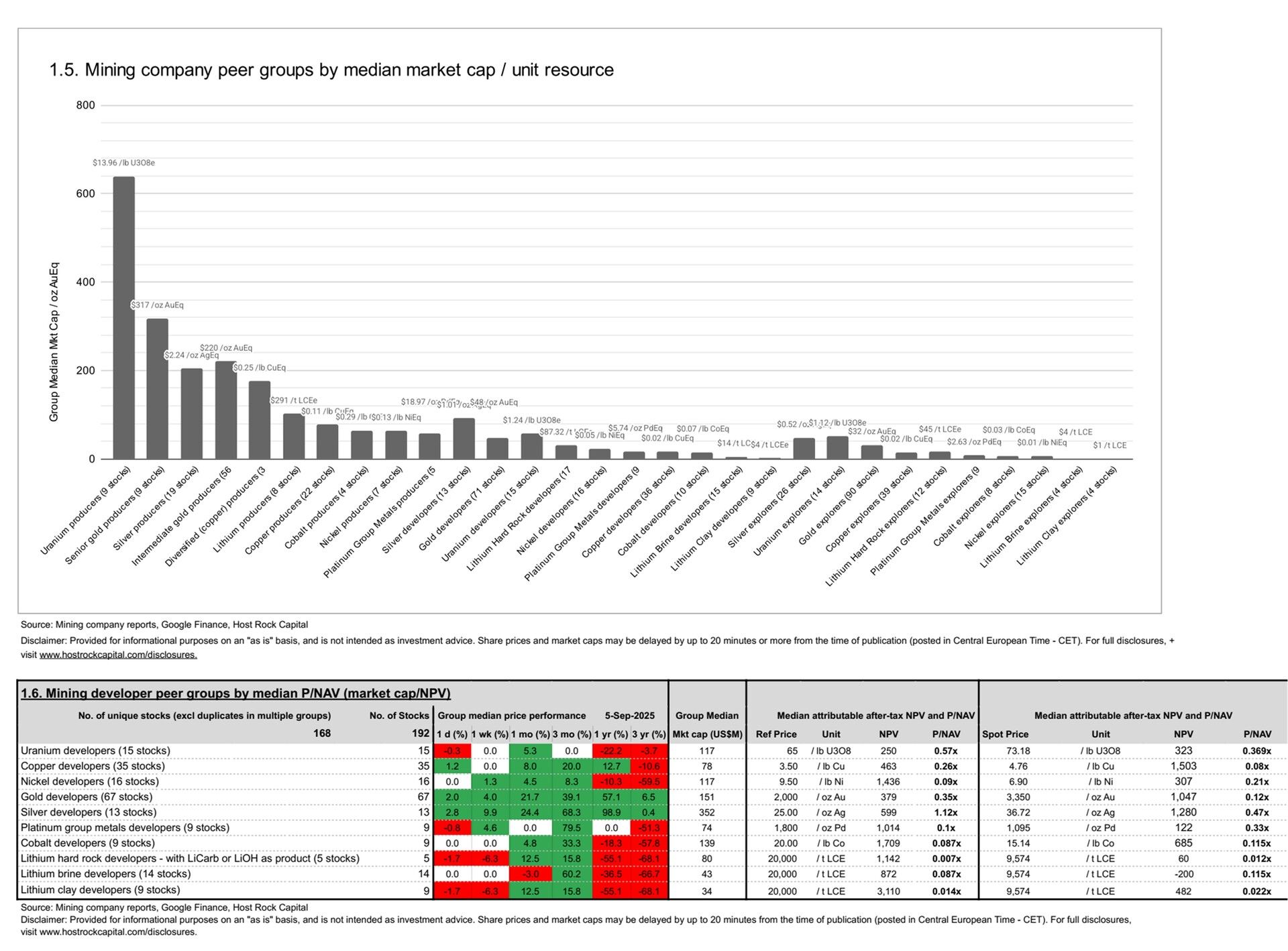

Precious metals prices and mining stocks gained this past week, with gold rising +4% to new highs around $3,600/oz.

This past week’s top & bottom metal price and mining company peer group movers include:

5 Sept 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 486) include (share price rounding errors apply, as sourced from Google Finance):

Covered mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

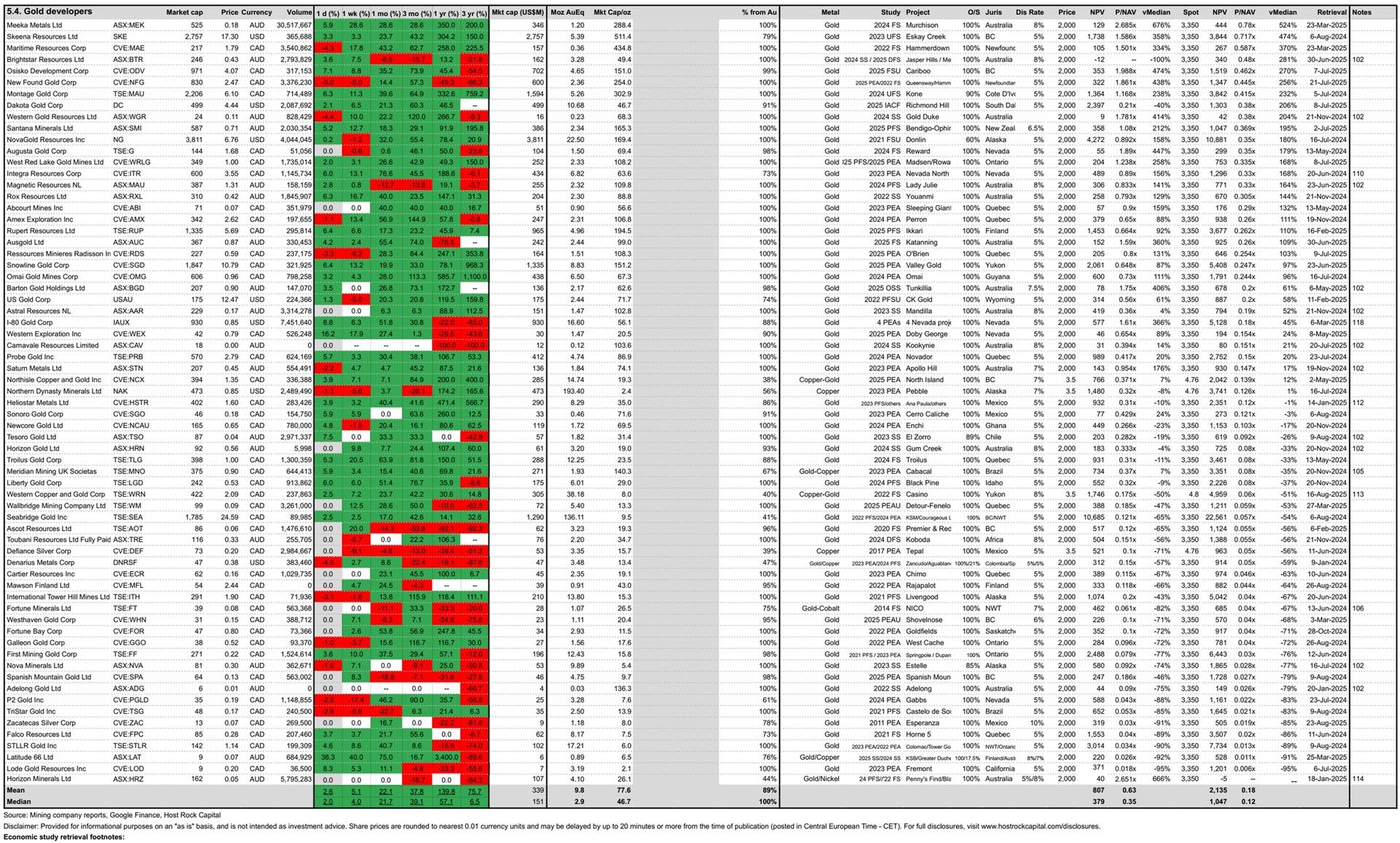

5 Sept 2025 – Gold developer New Found Gold (TSXV:NFG) announced the acquisition of fellow Newfoundland gold developer Maritime Resources (TSXV:MAE), in an all stock deal where MAE shareholders will receive 0.75 shares NFG per share MAE, for a 32% premium to MAE 20-day VWAP, with NFG and MAE shareholders owning 69% and 31% of combined entity. MAE’s FS-stage Hammerdown project is much smaller than NFG’s PEA-stage Queensway project (resource of 0.36 Moz vs NFG’s resources of 2.36 Moz). But Hammerdown (with FS in 2022) is much more advanced than Queensway, is a near-term producer (production targeted for 2026), is less costly to build (easier to fund) than the much larger and more valuable Queensway project – value that could more easily be unlocked with the cash flows (and P/NAV multiple) from Hammerdown. A similar strategy was employed by Discovery Silver Corp. Silver (TSXV:DSV) in its acquisition of Porcupine mine complex from Newmont Corporation (NYSE:NEM) announced in January (covered in our Weekly Rundown here:

https://lnkd.in/dthsXJKT with 200 impressions), from which cash flows can be used to help develop the company’s former flagship Cordero in Mexico. Since the DSV deal was announced in January (closed in April), DSV’s share price has quadrupled. NFG’s proforma basic shares on closing the MAE acquisition is reported in the release to be 335.93 sh. NFG stock traded down -4.6% on 5 Sept intraday following announcement alongside MAE that was also down -4.3% vs. gold dev peer median gain +2.0% intraday, but perhaps both stocks will gain next week once investors start to realize that NFG’s proforma market cap only sits at C$830m (at 5 Sept closing share price C$2.47), compared to the combined (post-tax) NPVs of both projects (at our 3-month trailing avg gold price of US$3,350/oz) standing at US$1.35b, for a ~P/NAV of 0.45x – only slightly higher than the 0.35x NGF closed at before announcement on 4 Sept, but well below the P/NAV MAE closed at on 4 Sept of 0.61x (at 3-month trailing $3,350/oz) – and a far cry from the P/NAV in the ball park of ~1x that might be expected from a junior gold producer (as NFG is now set to become in 2026, when Hammerdown is due to come online).

5 Sept 2025

4 Sept 2025 - Copper developer Koryx Copper (TSXV:KRY) announced an updated PEA for its 100%-owned flagship Haib project in Namibia, which replaces a prior 2021 PEA. The study contemplated 28 mtpa conventional milling and 7mtpa low grade heap leach (replacing the 20 mtpa bio-heap leach contemplated in 2021). So capex is obviously up signficantly (to US$1.559b), but the more conventional processes in this study should have much lower technical risk. Reported post-tax NPV8 at US$10,000/t Cu ($4.536/lb Cu) was US$1.742m with low all-in-sustaining costs of $2.46/lb Cu. At our estimated 3-month trailing average copper price of US$4.76/lb Cu, this NPV rises to $2.1b - encouragingly and somewhat surprisingly in-line with the 2021 PEA results at this price, despite the large jump in capex (for the mill). KYX stock traded up +2% 4 Sept after this announcement on strong volume, before closing week ending 5 Sept up +13% (vs. copper developer mean weekly gain of +1.9% to C$1.13/sh, market cap C$108m, and P/NAV (simplified as market cap/post-tax NPV) of 0.037x - a 55% discount to our 35-company copper developer peer group median 0.08x (at 3-month trailing $4.76/lb).

3 Sept 2025 (after-market) - Lithium brine developer Standard Lithium (NYSE:SLI) announced definitive feasibility study (DFS) results for its 55%-owned (through a JV) South West Arkansas project contemplating production of 22.5ktpa lithium carbonate, which replaces a prior 2023 PFS that contemplated production of 30ktpa lithium hydroxide monohydrate. As is often the case for this key derisking step up to DFS stage that has tighter costs estimating (and should be somewhat expected), the project’s economics took a bif of a hit since the 2023 PFS. Encouraingly, all-in operating costs remained low at US$5,924/t Li carbonate, although capex increased slightly by 14% to US$1.45b inlcuding 12.3% contingency (was $1.27b including 20% contingency in PFS), with a reported after-tax NPV8 of US$1.275b (for 55% attributable portion of $701m) at price of US$22,400/t lithium carbonate. At our reference lithium carbonate price of $20,000/t lithium carbonate, this attributable NPV decreases to $476m, resulting in a week ending 5 Sept closing P/NAV (market cap/NPV) of 1.18x (at US$3.07/sh). The prior 2023 PFS results had yielded a 55%-attributable NPV of US$1,166 at our reference lithium hydroxide price of $24,000/t (which we assume to be a 20% premium to our reference lithium carbonate price of $20,000/t for approximate comparison purposes), which had yielded a P/NAV of 0.48x (at prior SLI price of US$2.78/sh). Based on this apparent jump in P/NAV, SLI stock could take a hit in the ball park of up to ~30%+, which would create a buying opportunity for other investors looking for futher derisking steps towards first production targeted for 2028, for this most advanced and most de-risked li brine developement project in the US, especially considering the encouraing field-scale Direct Lithium Extraction (DLE) test results incorporated to this DFS (and reported on 11 March), which involved production of 3,672 litres of concentrated and purified lithium chloride solution from a field-scale DLE pilot plant using existing production wells.

Standard Lithium DLE field pilot. The larger blue and white enclosure houses the pre-treatment, filtration and DLE (LSS column) process steps (Source: Standard Lithium, 11 March 2025 press reelase). (Source: Standard Lithium, March 2025 press release)

5 Sept 2025

3 Sept 2025 - Lithium clay developer Ioneer Ltd. (ASX: INR | NASDAQ: IONR) announced updated economics, reserves, and resources for its 100%-owned Rhyolite Ridge Lithium-Boron project in Nevada, which replaced prior numbers in June 2025 DFS. Contained lithium in mineral reserves by +~4.7% to 2.01 Mt lithium carbonate, while overall resources +~2.4% to 4.07 Mt lithium carbonate. NPV grew substantially to US$1.9b (from $1.4b), but this appears largely due to a higher lithium price of US$23,012/t lithium hydroxide (was $13,423/t lithium hydroxide in June 2025), from initial capex of $1.7b that remained unchanged and low All-in-sustaining-costs of US$5,626/t lithium carbonate equivalent. And this time the NPV sensitivity to metal price was provided in the study/announcement, which we were able to retrieve and add to our Peer Table’s 9-company lithium clay developer peer group by P/NAV (taken as market cap/NPV). At our reference lithium hydroxide price of US$24,000/t (which we assume to be a 20% premium to our reference lithium carbonate price of US$20,000/t lithium carbonate for peer comparison purposes), INR’s NPV rises to US$2.05b with P/NAV 0.12x (on 5 Sept), making INR a premium stock among the group with mean P/NAV of 0.041x. This might suggest INR is one of the more likely Nevada Li clay projects to get built in the nearer term, especially given the Trump Adminstration’s Department of Energy’s January 2025 announcment of a $996 million loan guarentee for Ioneer.

5 Sept 2025

Rhyolite Ridge All-in Sustaining Costs (AISC) compared to other Projects (Source: Ioneer internal study and Benchmark Mineral Intelligence. Lithium Carbonate price estimate Benchmark Mineral Intelligence 30 April 2025 lithium carbonate spot CIF Asia). (Source: Ioneer)

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.