- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 6 June 2025 - Silver and PGM Metal Prices and Mining Stocks Dominate

Weekly Metals Mining Rundown for Week Ending 6 June 2025 - Silver and PGM Metal Prices and Mining Stocks Dominate

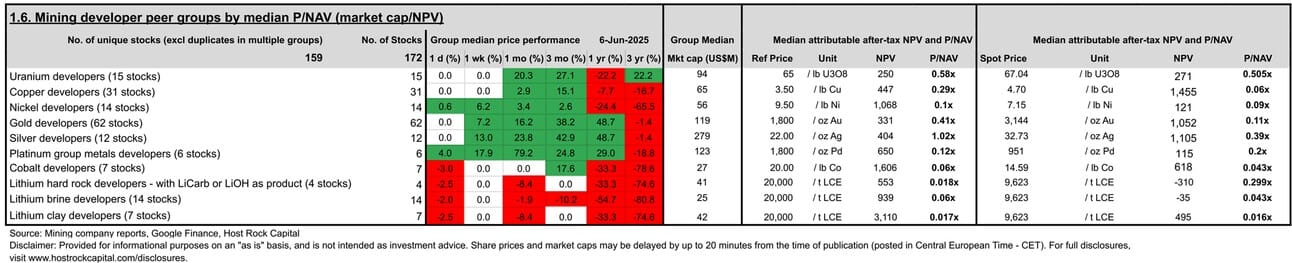

Rundown of company announcements, valuations, and underlying metal prices, according to our compilation of publicly available information covering 9 important metals and more than 450 mining stocks, including mineral resource inventories, and including project NPV information for some 150+ developers.

This past week’s top & bottom metal price and mining company peer group movers include:

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 458) include (share price rounding errors apply, as sourced from Google Finance):

Covered metals mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

6 June 2025 - Cobalt developer, and now also copper (and zinc-silver) developer Cobalt Blue (ASX:COB) announced results of a Scoping Study for its Hall Creek Copper-Zinc-Silver project in Western Australia, which supplements a prior 2020 PFS for Broken Hill cobalt project, which had been more of a flagship in the past, but now this Hall Creek project appears more front and center for the company due to its exposure to rising metal prices for Copper and Silver (and Zinc which is also starting to inch higher - up 3$% over last month). The Scoping Study yielded a fairly solid post-tax NPV of A$121M and post-tax IRR of 21.4% at $4.55/lb Cu from capex of A$149.3M (which includes a 20% contingency and includes A$106.1M in underground mine development costs). COB stock traded down (on 6 June) -4.7% after this news (vs. our 31-company copper developer peer group median performance of flat +0% and our 9-company cobalt developer group´s +1.1%), before closing the week (ending 6 June) down -14.3% (vs. Cu developer median flat+0%). COB´s combined mineral resources from both projects total 928 Mlbs CuEq or 263 Mlbs CoEq (1.4 Moz AuEq), which are 73% from Co, 13% from Cu, 12% from Zn, rest Ag-Ni-Pb-Au, at our estimated 3-month trailing average metal pricing. These resources trade at a week ending (6 June) COB market cap/lb of US$0.020/lb CuEq or $0.061/lb CoEq ($13/oz AuEq) - in-line (or just below) both our 31-company copper developer peer group median $0.021/lb CuEq ($13.8/oz AuEq) and 9-company cobalt developer median $0.061/lb CoEq ($13.1/lb AuEq).

6 June 2025

6 June 2025

5 June 2025 - Uranium explorer Premier American Uranium (TSXV:PUR) announced acquisition of fellow uranium explorer Nuclear Fuels (CSE:NF), for implied consideration of C$0.43 per share, representing a premium of 54% to NF´s 4 June 2025 closing price, which will result in one of America´s largest pure-play uranium explorers with a proforma market cap of C$102M (as stated in the release, reported to be based on proforma shares at closing and PUR´s 4 June 2025 share price of C$1.31), which will be 59% owned by PUR shareholders and 41% owned by NF shareholders. NF´s projects host combined historic uranium resources of some 11.2 Mlbs U3O8 (across its Bootheel and Moonshine projects in Arizona and Wyoming), but this excludes its main Kaycee project, where a 2024 NI 43-101 exploration target of 11.5 to 30 Mlbs U3O8 was published. Any or all of these projects (along with PUR´s pre-existing projects in Wyoming, New Mexico, and Colorado) could benefit from the Trump administration´s signaled policy support for development of America´s domestic uranium resources. Pro-forma PUR mineral resources (including PUR´s pre-existing 23.5 Mlbs U3O8 and including NF´s historic 11.2 Mlbs, but excluding any exploration targets) are 34.7 Mlbs U3O8. PUR stock traded up slightly +0.8% (on 5 June) following this news while NF stock traded up substantially +27% (vs. uranium explorer group median performance of +1.9%), before PUR closed the week (ending 6 June) down -3.4% while NF closed week up +12.9% (vs. U explorer median’s +3.3%), with PUR trading at a proforma week ending (6 June) market cap of US$2.29/lb U3O8 ($108/oz AuEq), apparently demanding a substantial jurisdictional policy premium over our 15-company (soon to be 14-company) uranium explorer peer group´s mean market cap/lb of US$1.14/lb (with PUR´s mineral resources set to grow).

6 June 2025

5 June 2025 - Gold, Nickel, and Cobalt explorer Nordic Resources (ASX:NNL) announced the completion of its acquisition of 3 Finland gold projects from gold explorer Northgold AB (formerly STO:NG) following NNL shareholder approval at an EGM held on 3 June 2025. Drilling is set to kick-off at these gold assets in July, following one other related NNL shareholder approval set for late June 2025, which is the approval the recently announced A$3.5 institutional placement. This follows a prior A$2.8M announced announced in April, together leaving the company cashed-up to take a meaningful step forward in growing & advancing its new flagship 0.81Moz AuEq Kospa project, along with 2 other resource-stage projects Central Finland - while also possibly making new discoveries across across its broader land package across the highly under-explored Middle Ostrobothnia, which already contains several targets requiring follow-up. NNL stock with it´s held resources of 5.8 Moz AuEq (15% from Au, 74% Ni, 7% Co, 4% Cu, at our estimated 3-month average trailing average metal prices) traded up +12.7% today (5 June) following this news (and closed week ending 6 June flat +0% in-line with peer group median flat +0%, and is up +50% over last month vs. peer median +7.2%), before closing the week flat +0% (in-line with gold explorer peer group median +0% flat) at a share price of A$0.093 (which is also up +50% over last month vs. gold explorer peers +7.2%) and market cap/oz resource of US$3.24/oz AuEq (assuming our forecasted pro-forma NNL shares outstanding of 323.2M upon closing of pending A$3.5M placement), which is 87% below our global 79-company gold explorer median $25.1/oz AuEq. And although we might expect NNL to trade at somewhat of a discount to gold explorer peers, given the group mean´s gold share of resources is 87% versus NNL´s lower 15%, this gap appears unjustifiably wide (not to mention this low gold share of resources is set to increase as NNL is now primarily focused on growing its gold assets)…We had previously (see LinkedIn post) suggested a more appropriate position for NNL in the market cap/oz pecking order might be the 13-percentile to 55-percentile range, especially as the ASX´s more global reaching pool of investors become aware of these newly acquired, attractive, near-development gold-copper assets, and have a chance to decipher their valuation vs. other ASX (and TSXV) listed peers, and especially as the potential/imminent cup-and-handle pattern plays out (that might be forming around NNL´s 200-dma around 9.1c/sh). This 13-percentile to 55-percentile range now corresponds to market cap/oz range of roughly US$7.5/oz AuEq to $32/oz AuEq (or a 2.3x to 10x increase, to a NNL share price in the range of A$0.21 to A$0.93). Historical data point worth mentioning, is that these assets (when they were fewer and smaller) traded up to a market cap of US$80M which was the 71-percentile EV/oz range of NG´s combined gold explorer AND DEVELOPER peer group (of 32 peers it had considered relevant at the time), back in April 2022 following its Feb. 2022 IPO (see chart below, retrieved from www.northgoldab.com in April 2022).

6 June 2025

Source: www.northgoldab.com (retrieved April 2022)

3 June 2025 - Copper developer XXIX Metals (TSXV:XXIX) announced a newly tightened resource estimate for its Opemiska project in Quebec, which paves the way for an upcoming PEA for that project (XXIX already has a 2021 PEA for its other Thierry project). The large, open pit-constrained resource update resulted in a reduced surface footprint, and lower strip ratio through conversion of some waste zones to low-grade zones. The overall estimate grew contained metal just slightly, to a reported 69.65 Mt in the indicated category, grading 0.84% Cu, 0.31g/t Au, 1.82g/t, containing 1.3 Blbs Cu, 0.70 Moz Au, and 4.1 Moz Ag and 80.615 Mt in inferred category, grading 0.28%Cu, 0.17 g/t Au, 0.62 g/t Ag, containing 0.49 Blbs Cu, 0.43 Moz Au, and 1.6 Moz Ag. This grew overall company resources (including the company´s other projects/resources Thierry and Roger) by just under ~1% to 5.3 Blbs CuEq or 7.9 Moz AuEq, now 67% from Cu, 21% from Au, rest from Ni, Ag, Pd, Pt (at our estimated 3-month trailing average metal prices). XXIX stock traded down -12% (on 3 June) intraday following this news (vs. copper developer group median performance of flat +0%), before closing the week (ending 6 June) down -7.7% (vs. peer median flat +0%), to a market cap/lb resource of US$0.004/lb CuEq ($2.63/oz AuEq) - a wide 81% discount to our 31-company copper developer peer group median of $0.021/lb CuEq ($13.8/oz AuEq). On P/NAV (taken as market cap/post-tax NPV), including only the 2021 PEA for Thierry (which will soon be supplemented by another PEA for Opemiska), XXIX trades at 0.12x - a 60% discount (was 46% discount on 3 June) to our copper developer peer group median 0.29x (was 0.21x on 3 June), both at our Reference copper price of $3.5/lb.

6 June 2025

6 June 2025

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. Host Rock Capital and its closely-related parties hold stake in Nordic Resources (ASX:NNL). For full disclosures, visit www.hostrockcapital.com/disclosures.