- Weekly Metals Mining Rundown - Free

- Posts

- Weekly Metals Mining Rundown for Week Ending 8 Aug 2025

Weekly Metals Mining Rundown for Week Ending 8 Aug 2025

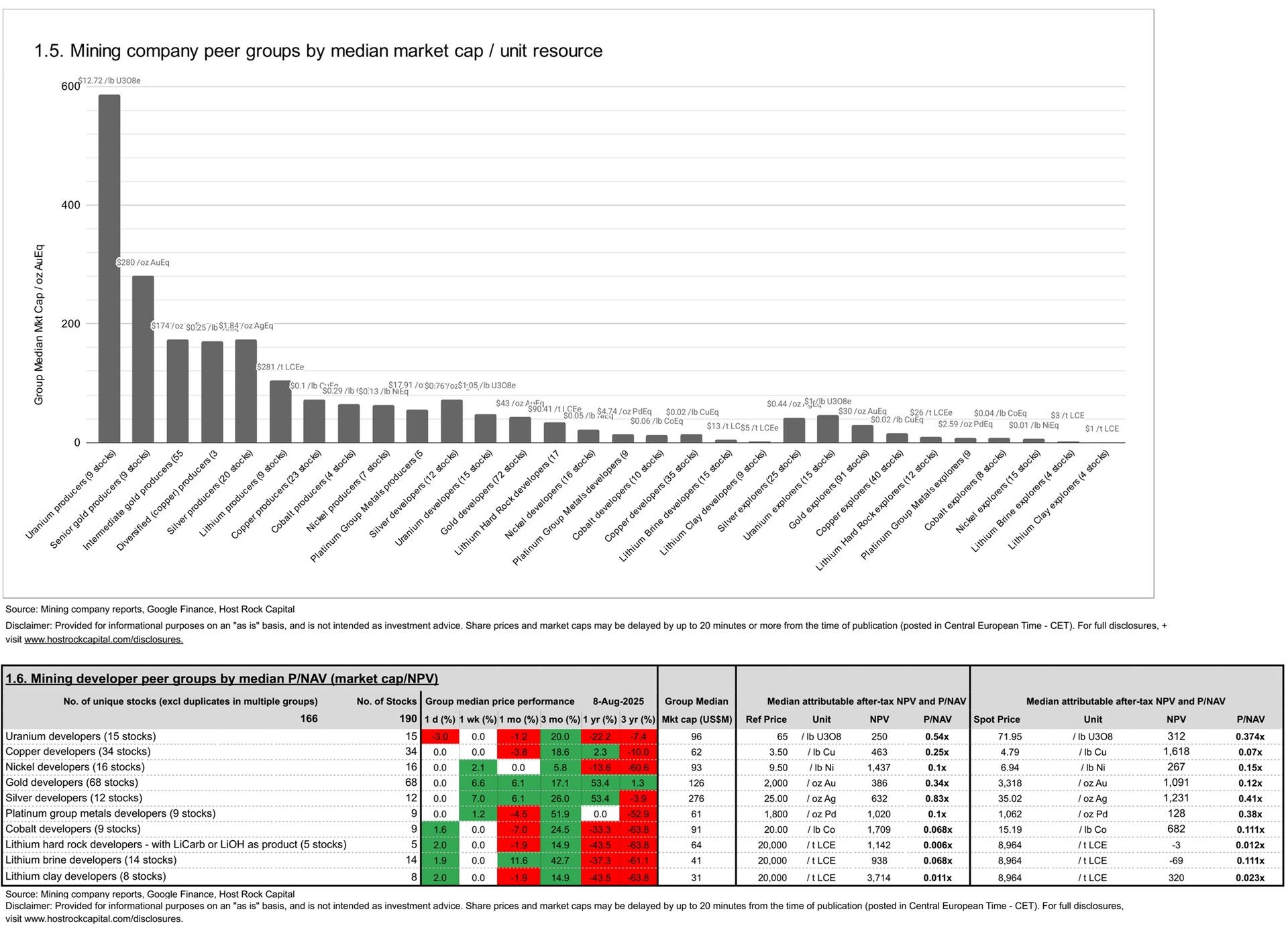

Silver price rose more than 3% to over $38/oz, while copper and gold prices rose 1% and platinum, nickel, uranium and lithium rose slightly; Most metals mining stocks closed the week green, led by silver and gold stocks with many experiencing double digit weekly gains, while most copper, nickel, lithium and PGM stocks saw lesser gains.

This past week’s top & bottom metal price and mining company peer group movers include:

8 Aug 2025

This past week’s top 40 performing metals mining stocks (out of Peer Table’s 490) include (share price rounding errors apply, as sourced from Google Finance):

Covered metals mining company announcements incorporated into this week’s Peer Table (resource updates, economic studies, changes in project ownership) include:

6 Aug 2025 - Uranium developer Denison Mines Corp. (TSX:DML) announced PEA results for its secondary 25.17%-owned Midwest Main ISR project in Saskatchewan. Reported post-tax NPV8 (100% basis) was C$965m at US$80/lb U3O8 from initial capex of C$254m. When combined with results of 2023 FS for Phoenix ISR and PSF update for Gryphon conventional (both 95%-owned), DML’s attributable NPV at our reference uranium price of US$65/lb U3O8 rises to US$1.49b, lowering P/NAV (market cap/NPV) to 1.3x, for this advanced-stage, nearly-permitted Wheeler River project (including super high-grade Phoenix, and nearby Gryphon), along with this new pipeline project Midwest Main (25.17%), which is above our 15-company uranium developer peer group mean P/NAV of 0.76x at same $65/lb U3O8.

8 Aug 2025

5 Aug 2025 - Nickel, copper, and cobalt developer The Metals Company (NYSE:TMC) announced the results of two economic studies: PFS for its NORI D project and an initial assessment of cash flow (IACF) for its NORI ABC & TOML project, both at the bottom of the Pacific Ocean. The PFS contains the first ever mineral reserve for a seabed deposit, which amounted to a probable reserve of 51 Mt grading 1.4% Ni, 1.1% Cu, 0.13% Co (and 31% Manganese) which supports the first 7-8 years of mine life in the PFS (the PFS mine plan contemplates mining total resources of 164 Mt out of total NORI D resource base of 363 Mt), resulting in a reported NPV8% of US$5.5b from initial capex of $545m at $9.21/lb Ni ($20,295/t Ni). The IACF contemplated processing resources of 670Mt (out of resource base of 1.3 Bt for NORI ABC & TOML project, for combined resource base of 1.6 Bt across both NORI D and NORI ABC & TOML projects) and yielded a reported post-tax NPV8 of $18.1b from initial capex of $8.85b at US$9.24/lb Ni ($20,360/t Ni). Both studies combined concurrently have a cumulative NPV of US$23.9b at our reference nickel price of US$9.5/lb Ni (according to metal price sensitivity provided in studies), which trade at a P/NAV (market cap/NPV) of 0.09x - just below our 16-company nickel developer peer group median 0.10x, and a 64% discount to our 34-company copper developer peer group median P/NAV of 0.25x at reference $3.5/lb Cu (36% of TMC’s resources come from Cu).

8 Aug 2025

4 Aug 2025 Nickel and gold explorer WIN Metals (ASX:WIN) announced a binding memorandum of understanding to acquire the past-producing Radio Gold mine in Western Australia, which is fully-permitted and offers near-term cash flow potential if restarted. WIN stock traded flat +0% today (5 Aug) at A$0.02/sh, before closing the week (ending 8 Aug) flat +0% in-line with gold explorer median performance, at a market cap A$12m, and market cap/oz resource US$0.013/lb NiEq ($6.1/oz AuEq) for its reported resources of 1.29 Moz AuEq or 618 Mlbs NiEq (30% Au from 0.39 Moz Au, 67% Ni from 415 Mlbs Ni, rest Li) at our estimated 3-month trailing average metal prices, which is in-line with our 15-company nickel explorer peer group median US$0.013/lb NiEq ($6.1/oz AuEq) and 88% discount to mean $0.105lb NiEq ($50/lb AuEq). And against our 91-company gold explorer peer group, WIN’s $6.1/oz AuEq trades at cheaper end at a 80% discount to group median $30/oz AuEq.

8 Aug 2025

8 Aug 2025

4 Aug 2025 - Lithium brine developer Lake Resources (ASX:LKE) announced a DFS addendum and updated ore reserve and resource statement for its flagship 80%-owned Kachi project in Catamarca province, Argentina, which supplements the Phase 1 DFS from December 2023. Reserves increased to 0.63 Mt lithium carbonate equivalent (LCE) while resources grew to 11.1 Mt LCE, with a 60% improvement to attributable post-tax NPV10 (of US$853m) at our reference lithium price of US$20,000/t LCE compared to 2023 DFS, which trades at a 8 Aug P/NAV (market cap/NPV) of 0.057x - an 11% discount to our 14-company lithium brine developer peer group median 0.064x and 30% discount to mean 0.082x.

8 Aug 2025

4 Aug 2025 - Gold developer Tesoro Gold (ASX:TSO) announced a resource upgrade for its flagship 89%-owned El Zorro project (Ternera deposit) in Chile, resulting in a 42% uplift in contained gold to a pit-constrained 1.82 Moz (grading 1.10g/t Au). Unconstrained resource grew to 2.0Moz @ 1.07g/t, which trade at at 8 Aug market cap/oz of US$25/oz AuEq - a 42% discount to our 72-company gold developer peer group median $43/oz AuEq. On P/NAV (market cap/attributable NPV) according to 2023 scoping study (which is now superseded by this resource upgrade), TSO’s 89% share of project trades at 0.23x at our (low) reference gold price of US$2,000/oz - a 33% discount to group median 0.34x (at our estimated 3-month trailing average gold price US$3,318/oz, TSO trades at P/NAV 0.08x - a 39% discount to median 0.12x).

8 Aug 2025

8 Aug 2025

5 Aug 2025 - Gold explorer Aurum Resources (ASX:AUE) announced a 50% increase to its JORC resources for its Boundiali project in Cote d’Ivoire in West Africa to 2.41Moz @1.0g/t Au, which grew group resources by 28% to 3.28Moz. AUE trades on 8 Aug at market cap/oz resource $34/oz AuEq - in between our 91-company gold explorer peer group median US$30/oz and mean $60/oz AuEq.

8 Aug 2025

Disclaimer: Provided for informational and educational purposes on an “as-is- basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.